Co-op Bank to cut branch network by at least 15%

- Published

The Co-op's ethics and values will be embedded in the Bank's constitution, say Group boss Euan Sutherland

The Co-operative Bank plans to cut its branch network by at least 15% by the end of next year, shedding 50 of its 324 branches and large numbers of jobs.

The bank said it would "significantly enhance" its internet and mobile banking services as a result.

The details came as it unveiled its rescue plan, drawn up at the weekend.

The deal will see creditors to the group, led by half-a-dozen hedge funds, end up with 70% of shares in the bank, leaving Co-op Group with 30%.

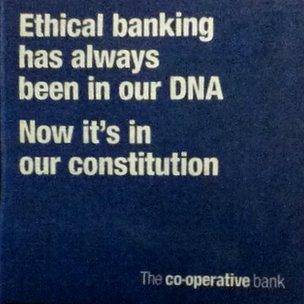

The Co-op Bank has taken out newspaper ads in an effort to reassure customers

Speaking about possible job cuts, Euan Sutherland, group chief executive, told BBC Radio 5 live: "We do need to take the overall costs down, unfortunately [that] will hit jobs, but we don't have the details today."

Mr Sutherland added that he was "optimistic" about the future. "We have taken a major step forward towards achieving our plan to secure the future of the bank," he said.

The Co-op Group will contribute funds of £462m towards the rescue plan.

It plans to list the bank on the London Stock Exchange in 2014.

Investors must now vote to back the plan if Co-op Bank is to avoid being taken over by the Bank of England in a process called resolution.

Culture

The Co-op Group hopes to protect the co-operative culture of the bank, by writing a pledge into the bank's principles or articles of association that it will conduct only what it sees as ethical business.

It has taken the unusual step of communicating this change to the bank's constitution to its five million customers in newspaper adverts.

Co-op had to come up with a rescue for its bank after the discovery of a £1.5bn hole in its balance sheet, caused by bad loans and the 2009 merger with Britannia building society.

Two weeks ago, the mutual group said it would lose overall control of the Co-op Bank, following a restructuring of a rescue deal, which will provide the bank with extra capital.

- Published22 October 2013

- Published22 October 2013

- Published21 October 2013

- Published29 August 2013

- Published24 April 2013