Amazon loses New York sales tax case

- Published

Amazon and Overstock.com lost an appeal to prevent a NY law requiring the firms to pay sales tax

The US Supreme Court has rejected an appeal to re-evaluate a New York state law that requires internet retailers like Amazon and Overstock.com to pay sales tax in the state.

The law forces internet retailers to collect taxes on purchases in New York.

The case could set a precedent in the US, where an estimated $23bn (£14bn) a year is lost in uncollected sales tax.

Amazon argued it shouldn't pay the tax as it doesn't have a physical presence in the state.

'Burdens of pain'

Both Amazon and Overstock.com brought separate cases against the law, which were joined into one ruling.

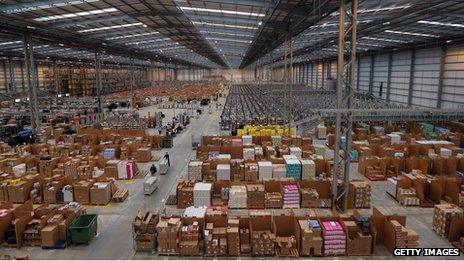

Neither company has any distribution facilities in New York.

They argued the law violated a 1992 US Supreme Court ruling, external which orders mail-order retailers to pay sales tax if they have "physical presence" in a state.

Amazon already pays sales tax in states where it has physical distribution centres

Amazon said New York's regulations "subject internet retailers to significant burdens of pain on serious civil and criminal penalties", according to a court filing.

The New York law says sales tax must be collected if a local resident is used to solicit sales online - which Amazon does, as it partners with local businesses to host ads promoting the retailer.

A lower court ruled this effectively creates an "in-state sales force".

Overstock.com suspended its local affiliate programme once the law was passed to avoid paying sales tax.

New York state lost an estimated $1.8bn in uncollected sales tax in 2012, according to the National Conference on State Legislatures.

"Amazon laws"

The law is part of a series of legislation passed in several US states dubbed "Amazon laws", external because they specifically target large online retailers.

Amazon has already agreed to pay sales tax in the 16 states in which it does have distribution centres, and has said it supports a federal law which would give states the right to collect sales tax on online retailers with at least $1m in out-of-state sales.

However, not all retailers support the agreement, and online auction site eBay has indicated it would oppose any such measure.

Globally, Amazon has come under fire for not paying enough tax.

Its UK subsidiary paid £2.4m ($3.9m) in corporate taxes last year, despite making sales of £4.3bn, prompting one politician to call the amount "pathetic".

In France, the government has retaliated against Amazon for collecting sales tax in Luxembourg, where rates are lower, by imposing restrictions on the amount the firm can discount books and prohibiting free shipping.

- Published2 December 2013

- Published21 May 2013