Autumn Statement: Overseas home owners to pay tax on UK property sales

- Published

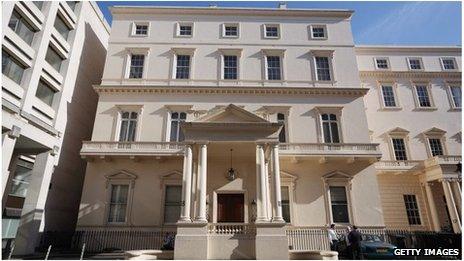

Foreign property owners will have to pay capital gains tax on rises in value on UK properties

Foreign property owners will pay tax on any gains in value on UK properties they own, under changes to capital gains tax announced by the chancellor.

Under the current system, only second home owners who are UK residents pay the tax, which is typically levied at 28%, on any rise in value when they sell a property.

The Chancellor, George Osborne, said the current system was "not right".

The tax change will come into effect from April 2015.

The move had been expected after the Deputy Prime Minister, Nick Clegg, said last month that the government was considering the change,

The new tax follows fears that foreign buyers of second homes are contributing to a housing bubble in London, where property prices are rising far faster than in the rest of the country. Values have risen by more than 10% in a year.

Wealthy buyers from countries such as Russia and China have been buying properties in London as a base for their visits to the UK.

Others from the eurozone have also bought as a hedge against any break up of the single currency area.

Mr Osborne said: "Britain is an open country that welcomes investment from all over the world, including investment in our residential property.

"But it's not right that those who live in this country pay capital gains tax when they sell a home that is not their primary residence - while those who don't live here do not."

'Wrong signals'

Estate agent Savills estimates that as much as 70% of newly built properties in central London are bought by foreign investors.

Paul Hackett, director of left-leaning think tank The Smith Institute, said the move was an attempt by the government to hold back prices in the capital.

"This shows that the government is worried about a London housing bubble, and it is vital that the extra funds raised from overseas investors will be ploughed back into genuinely affordable housing for people on low incomes," he said.

However, some said it would make no difference. Jennet Siebrits, the head of residential research at property experts CBRE, said: "The introduction of this tax may provide the wrong signals to overseas investors, and be seen to discourage their investment into UK property.

"However, while it might cause some disruption at the time of implementation, we do not believe this will have a substantial long-term detrimental effect on the wider residential market."

Time limit change

A further policy announcement on housing shortens the length of time a homeowner has to sell their main residence after they move out.

This was welcomed in one quarter as something that could help ease the supply of property.

Currently a home owner has three years in which to sell their main residence after having moved out, before suffering any capital gain tax charge.

The changes announced reduce this period to 18 months from April 2014.

Chris Harris, at accountancy firm MHA MacIntyre Hudson, said: "Many Housing Charities would favour this change as it is likely to free up housing stock more quickly."

However, he said that that caution would need to be exercised where a person moved into a care home for a period of time, as if their home was retained for longer than 18 months they would incur an unexpected tax charge.