UK economy growing at fastest rate since 2007

- Published

Chancellor George Osborne: "I am the first to say the job isn't done"

The UK economy grew by 1.9% in 2013, its strongest rate since 2007, according to the Office for National Statistics (ONS).

But growth in gross domestic product (GDP) for the fourth quarter slipped to 0.7%, down from 0.8% in the previous quarter, it said, external.

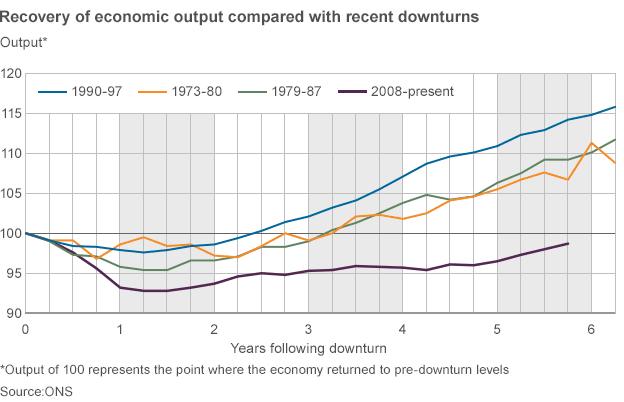

And economic output is still 1.3% below its 2008 first quarter level.

"There's plenty more to do but we're heading in the right direction," Chancellor George Osborne told the BBC.

In an interview with BBC business editor Robert Peston, Mr Osborne said: "The economic recovery is broadly based with manufacturing growing more than other sectors, and that's evidence that the long-term economic plan is working.

"We've learnt our lesson and what you see today ... is a rebalancing of the British economy."

The government's economic policies had helped provide businesses with a competitive environment in which to grow and hire people, he told the BBC, citing the fact that 450,000 jobs were created in 2013.

"This is a great place to invest and a great place to grow your business," he said. "That's a verdict that is shared by many people around the world who are now putting their money into the United Kingdom because they see us as a place where the economic future of the world is being shaped."

The recovery has been welcomed by bosses and politicians

The UK services industry - the biggest part of the economy - grew by 0.8% in the fourth quarter

A fall in North Sea oil and gas output dented industrial production

Despite big infrastructure projects like Crossrail, construction output fell 0.3% in the fourth quarter of 2013

The housing market has been boosted by the government's Help to Buy Scheme

But earlier, Ed Balls, Labour's shadow chancellor, said: "Today's growth figures are welcome and long overdue after three damaging years of flatlining.

"But, for working people facing a cost-of-living crisis, this is still no recovery at all."

'Bullish'

The UK's service sector - which makes up more than three-quarters of economic output - rose by 0.8% in the fourth quarter, the ONS said, matching its performance in the previous quarter. And the manufacturing sector grew 0.9%.

But growth in industrial production fell slightly from 0.8% to 0.7%, dragged down by falling North Sea oil and gas output.

Growth in the construction sector - which accounts for less than 8% of gross domestic product (GDP) - fell by 0.3% in the quarter, despite the recent recovery in a housing market boosted by the government's Help to Buy scheme.

John Longworth, director general of the British Chambers of Commerce, said: "These growth figures confirm what we've been hearing for some time.

"Businesses across Britain are growing ever more bullish about their prospects. Our surveys now consistently show business confidence levels not seen for decades."

Revisions

In December, the independent Office for Budget Responsibility revised its 2013 UK growth forecast from 0.6% to 1.4%.

It is currently forecasting growth of 2.4% for 2014, but if the economy continues recovering at its current pace, the OBR's revised forecast may also have to be revised.

The International Monetary Fund (IMF) also increased its growth forecast for the UK economy from 1.9% to 2.4%.

ING Bank's James Knightley said: "Employment continues to rise robustly, housing activity is very firm, confidence is on the rise, credit growth is improving and the UK's key export market - the eurozone - is showing some encouraging signs.

"Consequently, we believe that the economy can post GDP growth of 3% this year."

Labour's shadow chancellor Ed Balls: "We have a lot more work to do"

The ONS figures are themselves preliminary estimates, based on early submissions and are subject to revision.

Targets

Stronger GDP growth is leading to speculation that the Bank of England may be forced to raise its base interest rate - currently 0.5% - sooner than it had expected.

But governor Mark Carney has said the rate is unlikely to rise any time soon, despite the sharp drop in UK unemployment last week to a rate of 7.1%, close to the level at which it had said it would consider cutting interest rates.

Last week, however, the Bank said it would no longer use employment as a prompt for rate setting, but a wider range of measures.

Inflation has fallen to the Bank's target rate of 2%.

- Published28 January 2014

- Published28 January 2014

- Published28 January 2014

- Published28 January 2014

- Published23 January 2014