The US debt ceiling crisis that ended with a whimper

- Published

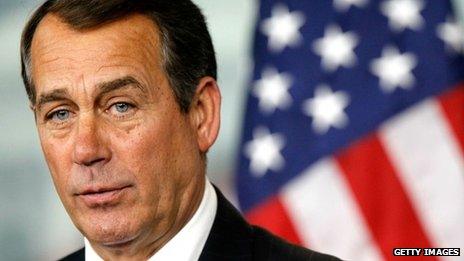

John Boehner - a dose of realpolitik or "giving in"?

The US Congress has agreed to raise the debt ceiling until March 2015, averting another crisis that almost four months ago threatened to trigger a default on US debt and plunge the global financial markets into chaos.

Raising the debt ceiling is the only way the US government can raise more money to pay off its debts. Without agreement, it runs the risk of default.

The issue has been an on-again-off-again headache for almost three years. But this time, it never really had the look of the honest-to-goodness end-of-capitalism crisis that came to a head last October.

Back then, just a couple of weeks short of defaulting on its debt, with the markets in crisis alert and the government in shutdown, Congress finally agreed to a temporary solution delaying the problem until this month.

Rather than the bang that some were expecting, it has now vanished with little more than a whimper.

This crisis had none of that drama: much of the fire has gone out of the Republican fight to keep the debt ceiling where it is.

Instead, mid-term elections in November have become their focus, and reluctantly they allowed the ceiling to be raised until March 2015.

The problem was that the "habit of governing by crisis" as President Barack Obama called it, was hurting the Republicans more than the Democrats. House Speaker John Boehner had tried to attach conditions to the bill, but simply couldn't get agreement from his party.

Drawing a line

Instead, accepting the realpolitik of an election year, he agreed to vote with 27 other Republicans for a "clean bill", no strings attached, to let the bill through.

He's been pilloried by right-wing groups of the GOP, most specifically the Tea Party, for "giving up".

But a lot of people breathed a sigh of relief, not least Mr Boehner himself, who, according to Reuters, external, was seen strolling from a news conference afterwards singing "Zip-a-Dee-Doo-Dah".

Now that a political line has been drawn under the debt ceiling debate, there is the question of where it leaves the economy. Republicans would argue that it leaves it with an ever-escalating debt.

But it has restored some faith among investors.

The deal in the House of Representatives came after the US markets had closed, but Asian and European equities rose - though they were also reacting to strong economic numbers out of China and optimistic comments from the new head of the Federal Reserve, Janet Yellen.

Madhur Jha, senior global economist at Standard Chartered, said: "The problem of the debt ceiling will of course keep coming back, but the economy has a year in which to recover, and by 2015 there may well be a real recovery taking place, which will help the economy fiscally."

Gain on the deficit, pain on the streets - last year's sequestration protests

Dangerous debts

Even with the start of the painful and unpopular sequestration last year, which is aiming to knock $1.1tn off the budget over the next eight years by forcibly cutting billions off spending each year, debt levels are only really going to come down as the economy grows.

Madhur Jha says: "Debt is not a problem if your economy is growing. There is a lot of debate as to what the proper level of debt should be for a developed economy, say 70%.

"The economists Carmen Reinhart and Kenneth Rogoff wrote a paper saying historically, growth has not suffered significantly until debts reached 90% of a nation's GDP. But it's still not clear. However, once you get over 100%, it really does begin to have structural effects on the economy."

However, Justin Urquhart Stewart, co-founder of Seven Investment Management, believes the US could be at a turning point. He says that there are signs that the annual budget deficit is coming under control.

He says: "If they can get it down to around 2% of GDP, then they will be able to hold the overall debt levels steady, and who knows, even reduce it. The sequestration helped last year on the spending side, but it is really the growth that is doing the work."

If that happens, there may not need to be another raising of the debt ceiling - a distant, if not forlorn hope. But there is a growing belief that the debt ceiling process is itself doing little to help the economy.

Faith in US economic governance has taken a real battering over the last three years, as the debt ceiling issue has been a circus for political fights between Republicans and Democrats.

Meanwhile, the rest of the world has looked on, knowing that if no deal was done and the US defaulted, the result would be, in the words of the US Treasury, "catastrophic economic consequences", external.

Who needs a debt ceiling?

So why not just do away with the whole political palaver? There are few other countries in the world where total debt is monitored in such a single-minded way.

Proponents of the process say it keeps Congress accountable. Opponents say it dates from a period when the President had far more influence in spending, and that a responsible Congress should be able to control spending as and when it was needed.

Mr Urquhart Stewart says: "The system is unable to distinguish between debt investment, long-term debt for the building of infrastructure, like power networks and bridges, and short-term 'household' debt.

"Each should be judged on its own merits and the debt ceiling process doesn't do that."

- Published12 February 2014

- Published18 October 2013

- Published4 February 2014