Tenant evictions reach their highest level ever recorded

- Published

Andrew slept in a car with his family, after they were evicted.

The number of tenants in England and Wales forcibly evicted from their homes last year after court action reached a record high.

Some 37,739 private and public sector tenants had their homes repossessed by court bailiffs in 2013, according to figures from the Ministry of Justice.

That is the highest number since records began in the year 2000.

However, the number of homes being repossessed by mortgage lenders at the end of 2013 was the lowest in a decade.

In cases that involved court action, 12,147 people had to hand back the keys to their home between October and December last year.

The Ministry of Justice put that down to low interest rates and a "proactive approach from lenders in managing consumers in financial difficulty".

'Ten minutes to leave'

Andrew, a 53 year-old from Dover, was one of the record number of tenants evicted in 2013.

He was forced to leave his home in November after a mild illness caused his work to dry up.

He and his wife had built up rent arrears of more than £3,000.

When the bailiff came, they expected to be given a reasonable amount of time to pack up their belongings.

"He said, 'Well guys, you've got 10 minutes.' That was just shocking, absolutely shocking," said Andrew.

Those belongings they could not pack were then left on the driveway in the rain.

They and their two young children subsequently spent several weeks sleeping in their car.

The cottage where Andrew's belongings were left on the drive

"There'd be the two boys in the back, under a couple of quilts. My wife would be up front here. And we'd eat in here," he told the BBC.

"The following morning, we'd go to McDonald's, so the boys could brush their teeth and then go off to school."

Three months after the eviction, they have managed to get a single hotel room, but only have enough money for two more nights.

They cook pasta in an electric kettle and warm up tinned food with hot water in the washbasin.

"I've eaten more pot noodle than I care to admit. It's grim," said Andrew.

'Changing circumstances'

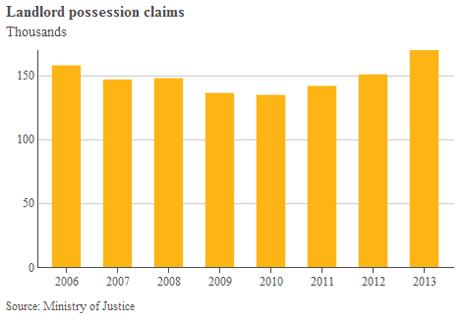

Landlord possession claims - the first stage of the process that could end in somebody losing their home - have also risen, standing at 170,451 in 2013, the highest since 2004, the Ministry of Justice figures showed.

Quite why more people are finding themselves in this situation or eventually being evicted is hard to determine.

It could simply be that more people are renting, or it could be that more landlords are turning to the courts for help with evictions.

The cost of renting has increased, but only marginally.

Figures from the Office for National Statistics (ONS) show that private sector rents across the UK rose by 1% last year, well below the rate of inflation.

But in places like London, rent rises may have outpaced wage increases.

"Rents have been rising at a faster rate than wages, and tenants are frequently maintaining their lifestyle on the basis of credit," said Stuart Law of the property group Assetz.

He said that many tenants had been lulled into a false sense of security by talk of an economic recovery.

"But when that credit dries up, and the unsustainable lifestyle continues, payment of rent suffers," he told the BBC.

Others were surprised by the figures.

The UK's largest lettings agency, LSL, reported last month that rent arrears were falling.

Ian Potter, the managing director of the Association of Residential Letting Agents (ARLA), said he too was surprised.

"I can only speculate that it's tenants who've suffered changing circumstances," he said.

The picture for those who own their own home is more positive, according to separate figures also published on Thursday, with low interest rates keeping mortgage costs down.

Banks and building societies reported that 28,900 homeowners had their property repossessed in 2013, the Council of Mortgage Lenders (CML), external said.

This was 5,000 lower than in 2012 and the lowest annual figure since 2007.

Advice

The housing charity Shelter says that if people want to stay in their homes when faced with eviction, they need to act quickly.

"Behind these figures is the reality that just one thing, like an illness or redundancy, can be all it takes to tip anyone into a downward spiral that puts their home at risk," said Campbell Robb, chief executive of Shelter.

The charity advises that rent payments should be the top priority.

Other debts, like credit cards or phone bills, should be negotiated later.

And those looking for an easy way out of trouble should not be tempted by payday loans.

Above all, it advises them, external to get professional advice, or call Shelter's free helpline on 0808 800 4444.

Meanwhile, Andrew and his family are still homeless. He has even considered begging on the streets, but is determined not to do so.

"We will find a home. It may not be where we want it to be, but we will find it," he said.

"We will make it our own, and we will look back on this as an experience."