Who loses from punishing Russia?

- Published

- comments

If trade and financial sanctions were imposed on Russia, the cost to the UK might well exceed the cost to Russia.

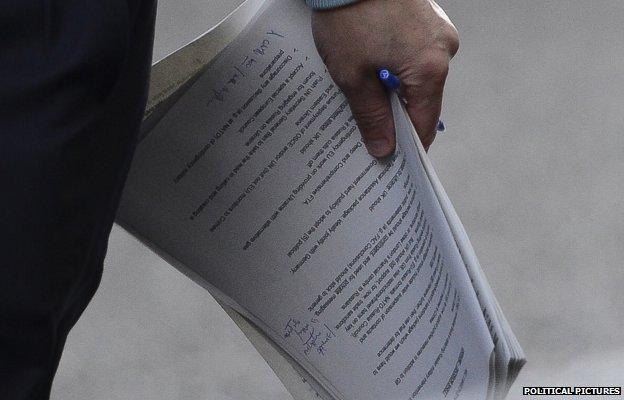

That is presumably why the Foreign Office wrote - in a document carelessly (or deliberately?) displayed yesterday for the lenses of photographers - that "the UK should not support for now trade sanctions or close London's financial centre to Russians".

Here's what the official figures show.

The UK had investments in Russia of more than £46bn in 2011 (the latest year for which data is available), rather more than Russian investments in the UK of £27bn.

On that basis, UK businesses and investors would have more to lose from asset freezes and seizures than their Russian counterparts.

Similarly, and this slightly surprised me, the UK has in recent years run a healthy current account surplus with Russia - which was £2.9bn in 2012, up from £2.1bn in 2011.

As you know (you do, you do) it is pretty unusual - and valuable - for the UK to be in surplus with a big economy like Russia, because we've been a deficit country in our economic relations with the rest of the world for more than 30 years.

And any cessation of trade and commerce with Russia would - apparently - make it even harder for the UK to start paying its way in the world once more, which is the burning ambition of this government, and would be necessary if the UK's debt burden was going to ever start lightening.

To be clear, it is the income from those investments in Russia that appears to be the big contributor to the healthy current account balance.

On trade in goods and services, the UK consistently runs a deficit with Russia - which was £1.8bn in 2012.

However the UK's assets in Russia generated £4.7bn more in income than was generated by Russia's UK assets.

And even if there is a trade deficit with Russia, it is a moderately important export market for the UK: UK exports to Russia were £7.6bn, a bit more than it sells to India, but less than sales to China.

Now quite a chunk of the UK's assets in Russia are BP's oil investments, which have been reconstructed since the release of latest data and have shrunk a bit. But they remain substantial.

As for which UK industries do well in Russia, as the snapped Foreign Office memo implies, the City is a winner: financial services trade with Russia was worth £889m in 2012.

Or to put it another way, it may be tempting to think that if trade and financial sanctions were imposed on Russia, the only losers would be a few Russian billionaire owners of expensive London townhouses and football clubs, but there would be potentially expensive costs for British business and investment interests.

And another thing.

There is some, but not massive, exposure of UK banks to Russia.

According to the Bank for International Settlements, UK banks have lent more than £19bn to the Russian public and private sectors, and have more than £42bn of contingent liabilities, most of it in the form of financial guarantees.

This doesn't represent a potentially devastating risk for UK banks, but is not trivial either.

What is more interesting about the BIS figures is they demonstrate that the US can afford to be much more aggressive in rattling economic sabres than Europe.

Of bank loans to Russia totalling £242bn, £184bn was provided by European banks - with the exposure being particularly big for French, Italian and German banks (in that order).

What this confirms - which won't be a shock - is that Europe is much more economically and financially connected to Russia than is America - and not only through European dependence on imports of Russian gas and oil (Russia supplies just under a third of gas consumed in Europe).

So European leaders will certainly take a deeper breath than America before announcing that Russia has become an economic leper that can't be touched.

By the way, none of this is to argue that it would be wrong to punish Russia by curbing the flow of goods, services and money to and from it. But it is just to point out - what may be obvious - that imposing sanctions would not be cheap or painless for the UK and Europe.