Can US gas exports change the global market?

- Published

There have been calls for the US to boost natural gas exports to counter Russia's dominance in the sector

There is a remarkable turnaround happening in the US energy sector, one that few would have imagined possible some years ago.

Once one of the biggest importers of energy, the country is now looking to export its ample resources to the rest of the world.

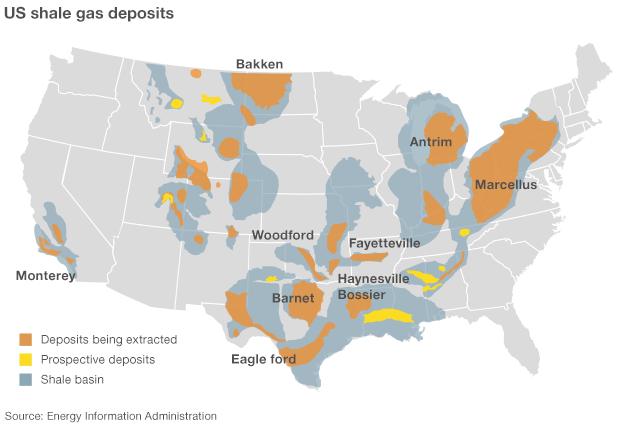

All this has been made possible by the booming gas output from the country's shale formations.

And now there are calls for the US to speed-up exports of natural gas, a move that some say will not only make it a dominant player in the sector, but also shake-up the global energy market.

But it is unlikely to be as simple and easy as it sounds.

Export restrictions

To begin with, under current rules companies need an approval to export gas to countries which do not have a free trade agreement (FTA) with the US.

This includes major global consumers such as nations in Europe and Asia.

The US Department of Energy (DOE) has so far granted approval to seven firms, external, but many of them still need to get a green light from the Federal Regulatory Energy Commission (FERC).

To make matters more difficult, these companies still need to build facilities that can handle gas exports, which currently don't exist.

These facilities take a long time to build and the first terminal is only expected to be ready by late 2015, at the earliest.

Most are expected to start only between 2017 and 2019.

"It takes about four years to get such a terminal up and running, and that is after you have all your approvals in place," says Tom Choi, national gas practice leader at consultants Deloitte MarketPoint.

Gas pricing

But there is one advantage that US enjoys over other energy markets, and that is pricing.

Natural gas prices in the US have been hovering around $4 (£2.4) per million British thermal units (BTU), a fraction of the costs in Europe or Asia.

One of the key reasons for this disparity is that companies supplying to European and Asian countries tend to link gas and oil prices, which drives costs between three or four times higher than the US.

Analysts say if the US, which does not index the gas prices to oil, starts exporting to these nations, it will bring down global prices.

The seven projects that have been approved by the US energy department have a combined capacity to export nearly 10 billion cubic feet (bcf) of gas per day.

To put that figure in context, it would be enough to meet the entire gas demand of Germany - Europe's biggest economy.

The energy department has applications pending from another 24 terminals looking to export more than 25bcf of gas per day, to countries that don't have a free trade agreement with the US.

Geo-political advantage

The calls for US to ease its export restrictions have gathered pace in recent days, amid the developments in Ukraine.

Some have suggested that US natural gas could help challenge Russia's dominance in the sector and reduce its political influence in the region.

Earlier this week, David Montgomery, a senior vice president at NERA Economic Consulting, estimated that increased US competition could drive down Russia's revenues from natural gas exports by as much as 30% over the next five years.

He said that Russia's revenues could fall by as much as 60% in the longer term.

"Since energy exports are the mainstay of the still inefficient and lagging Russian economy, this is a penalty with teeth," he told a US Senate Committee hearing.

He said that even if takes five to 10 years for US gas exports to reach a substantial level, a clear policy "would have an immediate effect on the pricing of natural gas and Russia's revenues".

David Goldwyn, a senior fellow at Brookings Institution said: "This bounty could enhance our national power by positioning our nation as a reliable supplier of natural gas to regions of the world that suffer from intimidation from their suppliers."

But some have argued that US exports are unlikely to begin soon and thus will not impact Russia in the near term.

They say Europe and other countries heavily reliant on Russian supplies will be better served by tapping into their domestic resources.

Domestic concerns

The US will also have to balance domestic concerns with its global ambitions.

Low-cost natural gas is widely seen as a key driver of the recent resurgence of manufacturing in the country - key to its continued economic recovery.

Cheaper gas has kept energy prices low in the US, while they have risen in Asia.

That, coupled with rising wages in countries such as China, has seen many firms bring some outsourced manufacturing back to US shores.

So plans to start exporting gas have triggered opposition from some sections of the industry.

The key concern has been that higher prices outside the US may see companies export more, creating a demand and supply gap in the US market, and raising domestic prices.

But industry watchers say any increase in domestic prices will be negligible and US customers will also benefit from falling global prices.

They say cheaper gas prices will lower manufacturing costs in countries that export goods to the US and result in lower prices.

There have also been concerns over the environmental impact of increased gas production, not least because of the process of fracking used to extract it.

According to research firm Advance Resources International, the US has technically recoverable shale gas reserves of more than 1,000 trillion cubic feet.

Most estimates suggest that it will have substantial surpluses available to export for decades to come.

The only question is: can it tap into these resources fast enough?