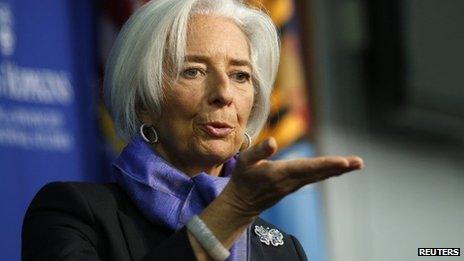

IMF boss Lagarde warns economy 'too weak for comfort'

- Published

- comments

The global economy is "too weak for comfort", Christine Lagarde said

The global economy could be heading for years of "sub-par growth", according to the head of the International Monetary Fund (IMF).

Christine Lagarde warned that without "brave action" the world could fall into a "low growth trap".

She said the global economy would grow by more than 3% this year and next, but that market volatility and tensions in Ukraine posed risks.

Ms Lagarde also urged more action to tackle low inflation in the eurozone.

'Unconventional measures'

Low inflation in the eurozone has been caused by the presence of a greater level of spare capacity in the economy, meaning it is not growing to its full potential due to underinvestment, compared to the US or UK.

The Bank of England believes the amount of spare capacity in the UK is equal to about 1% to 1.5% of overall GDP.

The strength of the euro relative to the pound and the dollar since 2012 has also lowered the cost of imports, forcing the price of goods to come down.

That has meant inflation in the eurozone is currently running at 0.5%, compared to 1.7% in the UK and 1.1% in the US.

The fear attached to lower inflation is it could harm the eurozone's nascent economic recovery, weakening consumer demand for goods and services as household's put off spending believing prices will continue to fall.

Low inflation also means that governments and businesses find it more difficult to repay their debts.

Ms Lagarde called on the European Central Bank (ECB) to pursue "more monetary easing, including through unconventional measures".

Eurozone warning

"There is the emerging risk of what I call 'low-flation', particularly in the euro area," she added.

"A potentially prolonged period of low inflation can suppress demand and output, and suppress growth and jobs."

Her advice to the ECB, in a speech on Wednesday, external, came the day before a meeting of the central bank's policymakers.

Economists do not expect them to announce any measures to reverse a drop in the region's rate of inflation, which fell to 0.5% in March, its lowest since 2009.

It was also the 6th month in what ECB President Mario Draghi has called "the danger zone" below 1%.

'Low growth trap'

The IMF's managing director said that global economic signs were positive overall, but that "without sufficient policy ambition, the world could fall into a medium-term low-growth trap".

She called for governments to reform labour markets to encourage job creation, and for more public investment such as transport and communications networks in rich and emerging countries.

In a speech seen as a precursor to the IMF's spring meetings in Washington next week, Ms Lagarde specifically referred to the US Federal Reserve's gradual winding down of monetary stimulus.

The US central bank is slowly reducing the rate at which it buys bonds, which has been pumping money into the country's economy.

But it has had a damaging impact on emerging markets, as investors withdrew money back to the US in the hope of achieving higher interest rates.

Ms Lagarde said there needed to be greater cooperation among policymakers to limit the impact of the Fed's tapering, and warned the problem could also "spill back" to the US.

She also warned the situation in Ukraine could have "broader spillover implications" if not well managed.

The IMF last week announced financial support of $14-18bn (£8.5-£11bn) for Kiev in exchange for tough economic reforms.

- Published25 January 2014

- Published15 January 2014

- Published7 January 2014