Barclays settles key Libor linked mis-selling case

- Published

Barclays has settled a case accusing it of mis-selling a financial product linked to Libor - the interest rate the bank attempted to manipulate.

The bank sold Graiseley, which owns Guardian Care Homes, an interest rate swap linked to the Libor interest rate.

Graiseley argued the deal was invalid because the bank's traders had tried to manipulate the Libor rate.

Barclays agreed to settle and as a result £70m of Graiseley's debt owed to Barclays will be reorganised.

A Barclays spokesman, said: "In response to discussions with Graiseley, in order to support the ongoing viability of Graiseley's care home business, the parties have agreed to a commercial restructuring of Graiseley's debt."

The bank was facing a trial over the case, so the settlement means that senior executives will not have to appear in court to give evidence.

The settlement, the first of its kind, will make it easier for other firms to make similar claims against banks.

Owen Watkins, a barrister at Lewis Silkin said: "Companies in a similar position to Graisley, if not already in correspondence with the bank that sold them the product, will probably pick up the phone to find out if there could be a similar 'commercial restructuring' in their favour."

Scandal

Between January 2005 and June 2009, Barclays derivatives traders made a total of 257 requests to fix Libor and Euribor, the European equivalent rate, according to a report by the Financial Services Authority, external.

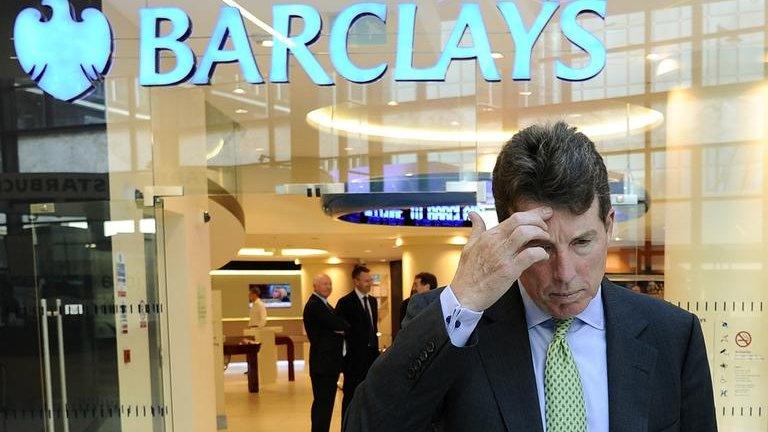

The scandal ultimately led to the resignation of Barclays chief Bob Diamond and fines for the bank totalling £290m imposed by UK and US authorities.

Other banks have also been fined for similar wrongdoing.

- Published17 February 2014

- Published17 January 2014

- Published27 June 2012