ONS: After six years, wage rises match inflation

- Published

- comments

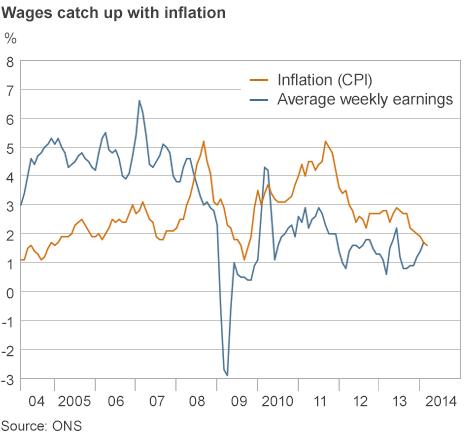

Wages are rising faster than inflation for the first time in six years

After nearly six years of falling real wages, rises in weekly earnings have finally caught up with inflation.

Weekly wages, including bonuses, rose by 1.7% in the year to February, up from 1.4% in January, according to the Office for National Statistics (ONS).

Consumer Prices Index (CPI) inflation stood at 1.7% in February and fell to 1.6% in March.

It is the first time that earnings have matched inflation for six years, apart from two months in 2010.

However, when bonus payments are excluded from the figures, wages rose by 1.4%, still below the rate of inflation.

The latest figures, external for wages measure the three months to February. At that time CPI was at 1.7%.

Other statistics from the ONS show how inflation has eroded the value of pay over the last six years.

While earnings rose by 8.6% since July 2008, prices rose by 16.9%.

Public sector

Although the figures suggest that people's purchasing power is now improving, it will be several years yet before real wages are back to the level they were before the financial crisis.

The Office for Budget Responsibility (OBR) has estimated that real incomes will not return to their 2009-10 levels until 2018 at the earliest.

And since the start of the financial crisis, real pay has fallen by a "colossal" 10%, according to Capital Economics.

That is said to be the biggest fall in any five-year period since the 1920s.

However, the government has said that all but the top 10% of earners are already seeing their incomes rise, once tax cuts are taken into consideration.

David Freeman from the Office for National Statistics says average pay rises are outstripping the rate of inflation for the first time in four years

The latest figures for average wage rises also conceal a marked divide between workers in the public and private sectors.

Those in the private sector are now enjoying average annual rises of 2%, including bonuses.

By contrast, those in the public sector are only seeing rises of 0.9%.

The figures also exclude the estimated 4m workers - around 15% of the total- in the UK who are self-employed.

According to the Resolution Foundation, such workers are more likely to be involved in "low paid odd-jobbing" rather than highly-paid entrepreneurial jobs.

In other words, the ONS figures may well over-estimate the actual level of pay rises.