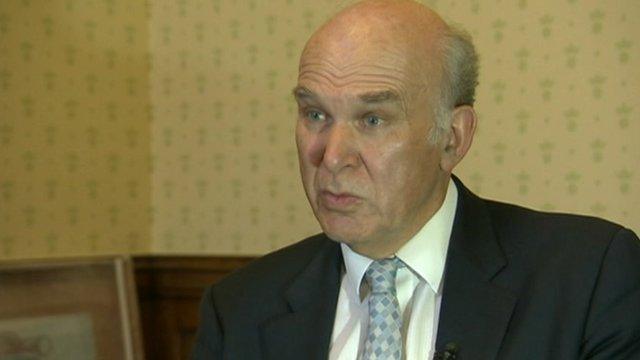

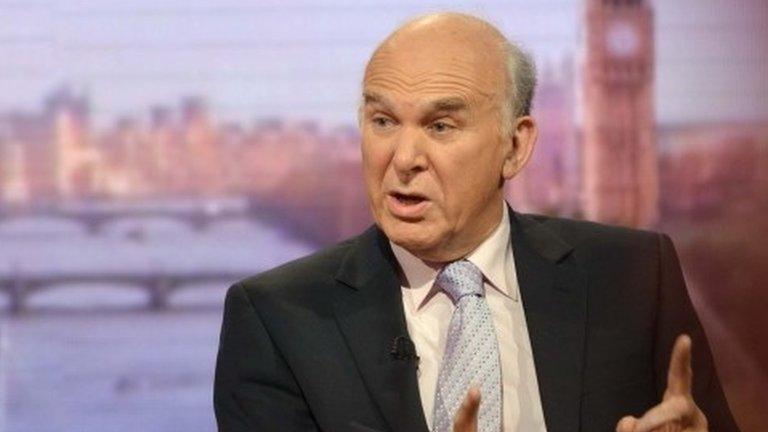

Vince Cable defends Royal Mail sale price to MPs

- Published

Watch: The UK Business Secretary, Vince Cable, stands by the initial pricing of Royal Mail shares, as he gives evidence to a parliamentary committee.

The Business Secretary Vince Cable has rejected claims that the government sold off Royal Mail too cheaply.

Mr Cable and Business Minister Michael Fallon were questioned by the House of Commons Business Committee over whether the government could have achieved better value for money in the sale.

"We don't apologise for it and we don't regret it," Mr Cable told MPs.

Royal Mail's share price has risen by almost 90% since the first day of trading in October last year.

"Hindsight is a wonderful thing," Mr Cable told the committee, "but on the basis of facts we had, the information we had, the knowledge we had of the company, this was a successful transaction".

The government initially priced Royal Mail shares at 330p each.

On the first day of trading on the stock market, the shares closed at 489p, and have soared 87% since, leading to claims that the company was sold off at too cheap a price.

Shares are now trading at approximately 521p.

Critics also say the share sale has allowed big banks and financial speculators to make a quick profit.

A report by the National Audit Office found that ministers in charge of the privatisation were too cautious when setting the sale price.

But ministers blamed the spectre of industrial action by Royal Mail employees for pricing the shares at 330p for the initial public offering.

The poor state of the world economy was also a factor, they said.

Mr Fallon told MPs: "Had we got a pay deal on time from 1 April last year and had a settled industrial relations climate, it's wholly possible we could have achieved a higher price."

'Fact of life'

Labour committee member Katy Clark asked if some large institutional investors had made a quick profit by selling out so quickly.

"It is just a fact of life, that is the way financial markets work," Mr Cable replied.

Mr Cable admitted he was "uncomfortable" with the notion of investors making short-term gains and that ministers may look at different ways to sell off public assets in future.

He also refused to name a group of so-called "priority investors", given a large allocation of shares with the aim of creating a stable, long-term shareholder base, but said he would pass a confidential list to MPs.

Some of the investors have sold part or all of their holding in Royal Mail.

- Published1 April 2014

- Published7 April 2014

- Published15 October 2013