Morrisons slashes prices in bid to win back customers

- Published

The chief executive of Morrisons, Dalton Philips, tells the BBC's Emma Simpson why the supermarket chain is reducing prices on essential products by 17%.

Morrisons has raised the prospect of an all-out supermarket price war with cuts on over a thousand of its products.

The company, which is one of the "big four" UK supermarkets, has been fighting to win back shoppers after months of falling sales.

It says prices on everyday essentials will now be 17% cheaper, on average.

All of the major UK supermarkets are under pressure from the rise of discounters, such as Aldi and Lidl, and the growth of online shopping.

However, Morrisons has been losing more customers to the discount retailers than its rivals.

After posting a dire set of annual results in March, Britain's fourth biggest supermarket said it would commit a billion pounds over the next three years to lowering prices.

'Value-led grocer'

Morrisons' boss, Dalton Philips, says the company is serious about making its products cheaper.

"I know this will be easy to characterise as a price war, or a fight-back against the discounters," he said.

"But this is not a temporary skirmish or a response to just one channel. It is about firmly re-establishing our credentials as a value-led grocer with a passion for food in a rapidly changing market."

Morrisons says it has never before launched price cuts on such a big and permanent scale.

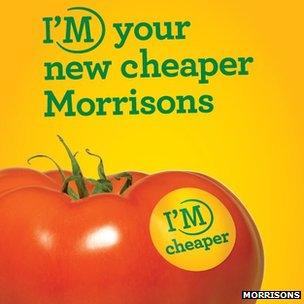

The price cut will be accompanied by an ad campaign and new website tools

Playing catch-up

But will the price cuts be enough to turn the company's fortunes around?

Some 1,200 products are included on the list of items to be discounted, around 35-40% of which are key branded goods.

But it is clear that on some of those products, Morrisons is simply playing catch up.

For instance, the supermarket says it is cutting the price of a pack of Huggies Pure baby wipes to £1 - a drop of 60%.

But you can already buy the same product for £1 at Asda and Tesco, while Sainsbury's offers two packs for two pounds.

The real battleground is on own brand items, like bread, milk and fresh produce.

Tesco is putting £200m into cutting prices on big selling core products.

The discounters have been upping their game, luring shoppers into the aisles with a limited but low cost offer.

These days they are small supermarkets, albeit with few branded goods. And they've been growing fast, stealing market share.

Airlines comparison

Mr Philips likens the shift in the UK grocery market to the changes seen in the airline industry, when new disruptive players - the budget airlines - came on the scene.

"The lesson is that once you see this disruption and fragmentation, the clock is not going to be turned back."

"And those who felt this was a passing fad or part of the economic cycle and failed to adapt, paid a heavy price."

Morrisons has lost some of its market share in the past year

Morrisons, he says, has grasped the nettle. But the retailer has its work cut out.

Asda was the first to change its strategy by introducing everyday low prices last autumn.

Morrisons is hoping to narrow the price gap with the discounters enough to persuade more customers to do a full shop with them, with their focus on fresh quality food.

It is launching a new feature on its website so people can compare what prices were before and what they are now.

Morrisons says it is so committed to its new plan, that no shelf price can be raised without the specific approval of its chief executive, or group trading director.

The new strategy also includes making shopping simpler, with fewer promotions, which can sometimes confuse the consumer. The company will also be cutting unnecessary pack sizes and varieties.

This is a big, bold, move by Morrisons. Not least because it means profits this year will be half what the City was expecting.

There's a lot riding on whether these cuts translate into a much needed rise in sales. The turnaround isn't going to be easy or quick.

- Published13 March 2014

- Published13 March 2014

- Published9 January 2014