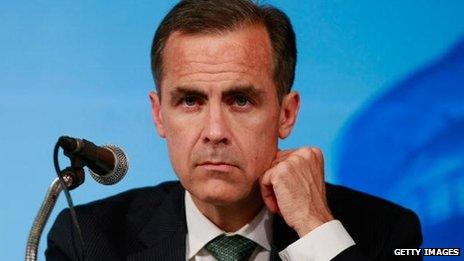

Is Mark Carney nannying insurers?

- Published

- comments

Governors of the Bank of England have not historically fired shots across the bows of the insurance industry - because the Bank of England has never had responsibility for regulating and supervising insurers till given these duties by the current government.

So Mark Carney's stern warning to insurers, that the Bank of England is keeping a beady eye on them, to keep them on the straight and narrow, is something of a first.

Some of what he wrote in the Times was fairly uncontroversial. Saying that insurance bosses who do wrong should and will face the same tough new penalties that are being introduced for miscreant bankers will be seen as reasonable.

And the Bank of England would not be doing its new job if it failed to raise concerns, as Mr Carney has, that some insurers are making dangerously risky investments right now - which they have an incentive to do because supposedly safer investments, such as government bonds, deliver miniscule yields or income.

As I understand it, this reckless investment is particularly characteristic of general insurers, who have struggled to increase premiums - rather than life insurers, who have reacted to the low-interest-rate climate by slashing annuity rates, to protect their profits (thus upsetting pensioners, and prompting the Chancellor to end the requirement on savers in money-purchase pension schemes to purchase annuities on retirement).

But there is one statement Mr Carney made which may stir up something of a debate in the City, and more widely, because it may be seen as the Bank nannying too much.

Failing insurers

He said that although the role of the Bank is not to stop insurers from failing if they manage their affairs badly, it is to "make sure that failing insurers don't harm their policy holders, cost the taxpayer money or make insurance harder to obtain".

After the City debacle of 2007-8, which was so expensive for the public sector, few would want taxpayers on the hook to bail out insurers on the brink.

But why should policy holders be protected from losses? Is there only a de minimis role for caveat emptor when buying insurance?

If the Bank of England sets itself up as the protector of policyholders, why should they bother to shop around to give their cash only to prudently managed insurers?

And what incentive would there be for the insurer to manage itself prudently? Surely it would be rational for an insurer to offer investment products that promise unrealistic returns, or general insurance priced too cheaply, if customers believe the Bank of England will insulate them from losses in a crisis.

Also, if insurance is cheap and plentiful before a crash because insurers are behaving as the banks did before the Crash, viz they are generally under-pricing risk, it would surely be a good thing if insurance became harder to obtain.

In that sense it seems odd that Mr Carney should set up the Bank as promising to prevent any tightening in the market.