What does Iraq's crisis mean for oil?

- Published

Militants have reportedly seized towns and military checkpoints in the north of Iraq.

Islamist militant gains in Iraq, and a threatened move on Baghdad, have created a sense of fear in oil markets.

The UN said hundreds have been killed as the Sunni-led Islamists advanced into Diyala province in the east - near Iran and close to the capital - having seized Mosul and Tikrit to the north.

Militants have also invaded Iraq's biggest oil refinery at Baiji after a siege lasting a week.

Led by the Islamic State in Iraq and the Levant (ISIS), the insurgents have threatened to push to regions further south dominated by Iraq's Shia Muslim majority, whom they regard as "infidels".

We take a look at why this is leading to higher oil prices.

Where is the fighting?

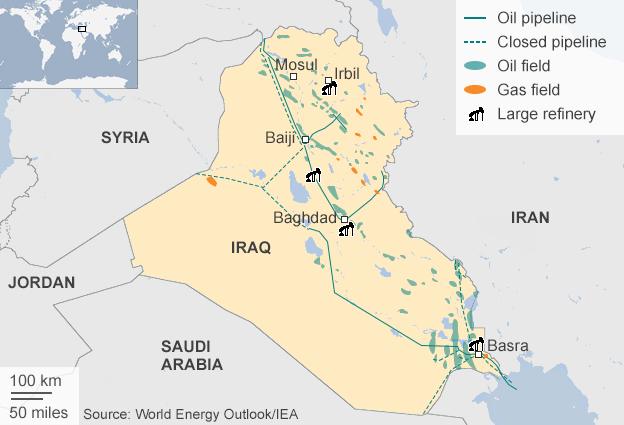

Much of the fighting and seized territories are in the north of the country, while about 70% of the production is in the south, says David Horgan, chief executive of Petrel Resources, an oil company that's been in Iraq since 1999.

"In a way this isn't a new problem," as areas of Iraq such as Falluja, which was seized by ISIS at the end of last year, have often been subject to unrest and rebellion, he says. "But what's happened here is a major escalation. ISIS has managed to turn back the army."

"It's bad news but it doesn't affect production immediately," he says. But events such as this make oil production difficult.

Iraq produces around 3.3m barrels of oil each day.

Production didn't recover after the second Gulf war, and attracting the money needed for wells and exploration is hard.

"It's difficult to get people and capital committed to Iraq."

Where is Iraq's oil?

The attack on the oil refinery at Baiji, which shut down production on Tuesday, has reportedly left insurgents in control three quarters of the site.

However, many of Iraq's productive oil fields are in the south, away from the conflict.

The northern region outside the Kurdish zone isn't producing much oil, says Paul Stevens, a professor and fellow at Chatham House.

It probably has the world's second-largest conventional oil reserves, he estimates. But lower post-war production means it's a less important market than it was.

In terms of foreign investment, companies lost interest in Iraq's government, which they see as difficult and unco-operative compared with other markets.

"Production has been struggling because there are problems of maintenance and infrastructure," he adds.

Why is this affecting the price?

The price of Brent crude has made a series of sharp gains since the beginning of April, when the price was around $105 per barrel, now standing at about $113.50 per barrel.

"In the oil market there's a general sense that trouble in the Middle East means a higher oil price." says Prof Stevens, so the market may not be acting proportionately.

"The oil price shouldn't be affected that much unless there's a major collapse in Baghdad." Fear and uncertainty are playing a part in the price, he said.

A deal between Washington and Tehran on nuclear sanctions would help, says Prof Stevens, as it would add a lot more supply if oil embargoes were lifted from Iran.

"Oil price is a funny thing," says Mr Horgan. Each barrel of oil may be traded many times before it's used - "it's a speculative market driven by expectations."

What about the future?

Iraq was created by western powers from the remains of the Ottoman Empire after World War One.

"If it collapses and fragments, the rest of the Middle East is also artificial", so there could be a knock-on effect, Prof Stevens said. The various rump states could find allies - the Kurdish north with Kurds in Syria and the Shia-dominated south with Iran - and that could lead to further conflict. That would only slow production, he says.

We are still very dependent on Middle Eastern oil, says Mr Horgan. There are today only about 80 days of reserves worldwide, down from a peak of more than 100 days.

While new oil sources like shale oil are being developed, more is needed to keep up with demand. "The big reserves are in the Middle East, Siberia and Venezuela, and those countries are largely closed to international exploration."

- Published13 June 2014

- Published13 June 2014