Kenya's debut Eurobond sale sees strong demand

- Published

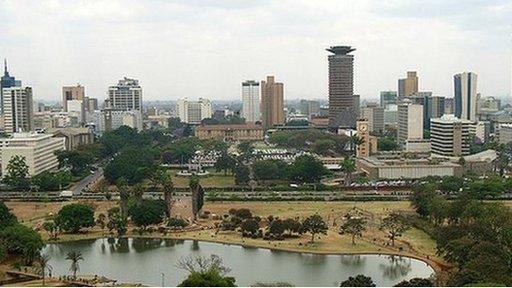

The Kenyan capital Nairobi has grown into East Africa's biggest city

Kenya's first effort to raise capital from European and American investors is being seen as a success after it attracted strong demand.

The country sought to raise $1.5bn through the Eurobond, but eventually raised $2bn after it attracted bids four times its initial target.

US investors bought about two thirds of the bonds, with British investors taking a quarter.

President Uhuru Kenyatta said the sale was a "vote of confidence" in Kenya.

He said that the funds raised would cut the government's local borrowing requirement, which would help it to reduce interest rates.

"[This] should boost investment, spur economic growth and provide more employment opportunities to our people," added Mr Kenyatta.

Kenya's finance minister Henry Rotich said it planned to borrow more money internationally in the next financial year.

"But we are going to diversify, we may look at other [types of instruments] that is like sukuk bond, diaspora bonds or other denominations. So we are still engaging on what other financial products are out there," he added.