Alibaba profits surge ahead of US stock market debut

- Published

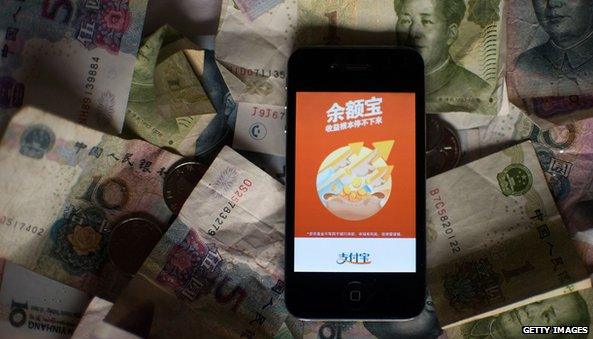

Alibaba has also expanded into mobile banking with its Yuebao investment product

Profits at Chinese e-commerce giant Alibaba have nearly tripled ahead of the firm's planned US stock market debut this autumn.

In a filing, external with US regulators, Alibaba said second-quarter profit was 12.3bn renminbi ($2bn; £1.2bn), compared to 4.3bn renminbi last year.

The firm will list on the New York Stock Exchange later this year.

It is expected to be the biggest internet stock offering since Facebook's in 2012.

Many analysts believe that the company could raise over $20bn in its stock market debut, which is expected to happen in September.

That would value the company at somewhere between $130bn and $150bn.

Mobile boost

Those hoping to invest in the firm - which controls the lion's share of China's rapidly expanding e-commerce market - were cheered by the increasing number of users accessing Alibaba's various sites via their smartphones.

Monthly active mobile users increased to 188 million for the quarter, which ended on 30 June, an increase of 25 million from the prior quarter.

And those users were increasingly eager to spend: Alibaba said mobile merchandise sales nearly quadrupled, and now make up nearly a third of all merchandise volume sold on the site.

Founded in 1999 by Jack Ma, Alibaba controls several popular internet sites in China, including Tmall - where brands can sell their wares - and Taobao, the world's largest online shopping website.

- Published13 August 2014

- Published26 June 2014

- Published18 March 2014