Australia's mining tax repealed

- Published

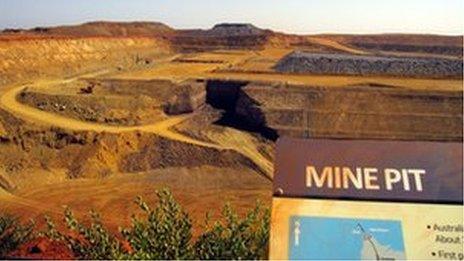

Australia's previous Labor government had levied a mining tax to raise funds

Australia's government has repealed a controversial mining tax after striking a deal with business tycoon Clive Palmer's political party.

The 30% tax on mining profits on coal and iron ore was first introduced by the former Labor government in 2012.

The country's Senate voted to remove the mining tax, and the bill is now heading to the House of Representatives where it is expected to pass as well.

Mr Palmer's party had agreed to the move in return for certain concessions.

This includes freezing the government's contributions to state pensions and keeping a bonus programme for school children.

The Palmer United Party - set up by the mining magnate last year - holds the balance of power in Australia's senate.

Prime Minister Tony Abbott and his centre-right cabinet have been looking to get rid of the unpopular mining tax.

.jpg)

Australian mining billionaire Clive Palmer has become a powerful politician

Large mining firms such as Fortescue Metals Group and Xstrata had also opposed the so-called Mineral Resources Rent Tax (MRRT), saying it hurt their competitiveness and affected future investment in the sector.

According to the Australian Broadcasting Corporation, Treasurer Joe Hockey said the mining tax was "testament to a failed Labor Government, failed economic policy, failed taxation policy and a failed treasurer".

"The fact is, we promised we would set about fixing the economy and fixing the budget, and that is exactly what we are doing" he said.

This is not the first time Australia has repealed an unpopular tax. In July, it became the first developed nation to repeal its carbon tax legislation.

The laws had sought to put a price on greenhouse-gas emissions, but generated years of political debate.

Australia's economy is heavily dependent on mining, which has contributed to it being one of the world's largest per capita greenhouse gas emitters.

However, the carbon tax has been blamed for higher energy bills and living costs.

- Published23 August 2012

- Published20 March 2012

- Published19 March 2012