How would a mansion tax work?

- Published

Analysts have been speculating about the effect of a tax on expensive homes

Both Labour and the Liberal Democrats are promising to bring in a mansion tax if they win the election.

Labour leader Ed Miliband said that owners of properties worth more than £2m would face an annual charge.

It is a similar idea to the proposal outlined in the Liberal Democrat's 2010 general election manifesto that was restated at their last conference.

So how could such a "tax" work and who would be affected?

Some analysts have pointed to the complexity of a mansion tax, debated how much would be raised, and discussed the effect on house building.

What is a mansion?

Homes with a £2m price tag can range from multi-bedroom houses to flats

The image of a mansion for most people is a country home, in acres of grounds, perhaps with a tennis court or stables in view from the window of one of the many bedrooms.

However, owing to the significance of location, homes subject to a mansion tax would be of very different shapes and sizes.

Labour and the Liberal Democrats put the threshold of a tax at properties of £2m.

Properties advertised for sale on internet portal Rightmove with a price tag of £2m include a two-bedroom apartment in an Art Deco building in London, but also a six-bedroom, four-floor detached home in Hale, Greater Manchester.

Estate agent Knight Frank suggests that 36% of £2m-plus homes were detached, 31% were terraced, 22% were flats and 11% were semi-detached.

Yet, there is also a debate over how homes are valued. At present, council tax bands are still based on valuations of homes made in 1991.

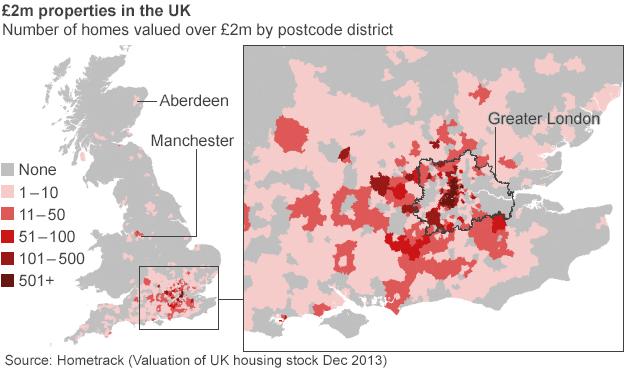

How many homeowners would be affected?

The answer to this question tends to depend on who you ask.

Hometrack, which values properties for banks, builders and provides analysis for estate agents, says there are about 58,500 homes with a value in excess of £2m across Britain.

But estate agent Savills estimates there are about 97,000 properties in the UK. Internet portal Zoopla puts the number at about 108,000, and estate agent Knight Frank puts the total at about 110,000.

All are agreed that the vast majority of these properties - well over 80% - would be in London and the South East of England.

In 2010, the Lib Dems estimated that 70,000 properties would be affected.

What plans are on the table?

Labour leader Ed Miliband outlined his plan for a mansion tax at his party's conference

Labour are suggesting an annual charge for homeowners with properties worth more than £2m.

However, Labour says this would be a progressive tax, so those with the biggest homes would pay proportionately more than those just above the £2m threshold.

That threshold would also rise in line with rising house prices, so homeowners would not be dragged into the tax as a result of their existing home rising in value.

Labour also say there would be protection for cash-poor but equity-rich owners - likely to be the option of paying the charge from their estate when they die.

The proposed scheme would raise £1.2bn a year, Labour say.

In 2010, the Lib Dems proposed a mansion tax based on 1% of a property's value above £2m. This threshold would also rise in line with increasing house prices.

Under this plan, for example, a property worth £3m would face a charge of £10,000 a year. The party said the tax would raise £1.7bn a year.

At their 2014 party conference, Lib Dem leader Nick Clegg said that this tax would be incorporated into the Council Tax system, to cut bureaucracy. He said raising a Council Tax band would allow them to collect the extra money that would be used to cut the deficit.

In 2013, David Cameron ruled out imposing a mansion tax. He told the BBC that a "wealth tax is not sensible for a country that wants to attract wealth creation, wants to reward saving and people who work hard and do the right thing".

What has been the reaction?

In a study published in February, the Institute for Fiscal Studies (IFS) said that a mansion tax had a "sensible logic underpinning it".

However, it said the idea was misdirected.

"Rather than adding a mansion tax on top of an unreformed and deficient council tax, it would be better to reform council tax itself to make it proportional to current property values," the IFS report said.

Some housebuilders and estate agents fear that the mansion tax will curtail building of new homes in London and the South East of England, where a shortage of supply has been one of the factors pushing up prices.

"Any policy initiatives should concentrate on nurturing the embryonic buds of growth outside of London, rather than drastically pruning back healthier branches of the market," says Peter Rollings, chief executive of Marsh & Parsons estate agents.