Warren Buffett sells more than 245 million Tesco shares

- Published

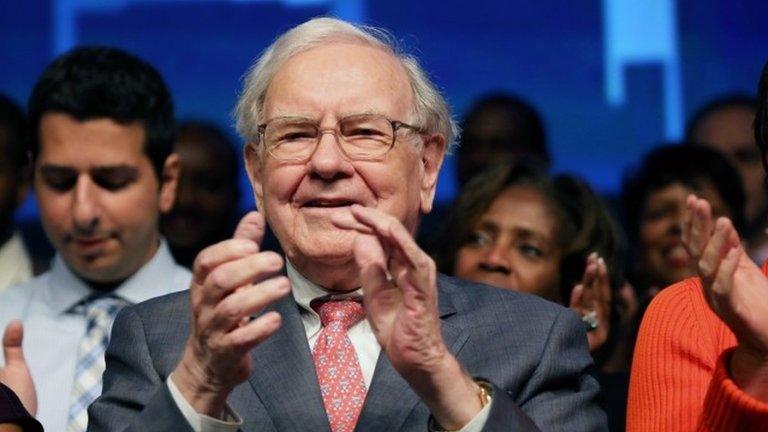

Warren Buffett, nick-named "the Sage of Omaha" is known for taking the long view on his stock market investments

Warren Buffett's Berkshire Hathaway investment company has sold more than 245 million shares in supermarket giant Tesco.

The sale brings Berkshire's holding to below 3%.

Earlier this month, Mr Buffett, nick-named "the Sage of Omaha", said his decision to invest in Tesco had been a "huge mistake".

Berkshire Hathaway owned 3.7% of Tesco at the end of 2013, a stake worth about £1bn.

The supermarket's share price has plunged more than 50% over the last 52 weeks after falling sales and accounts mis-reporting has unsettled investors.

"I made a mistake on Tesco. That was a huge mistake by me," Mr Buffett told CNBC in early October.

Another major investor, Blackrock, also began selling down its 5% Tesco stake in September.

Long-term investing

Mr Buffett is known for taking long-term bets on established companies rather than investing in riskier stocks.

His portfolio of investments include well-known brands such as Coca-Cola, IBM and American Express.

Berkshire Hathaway began building a stake in Tesco in 2006, and by 2012 owned more than 5% of the business.

But Tesco has struggled in the face of increased competition from discount retailers such as Aldi and Lidl, and the failure of some of its international ventures.

A series of profit warnings and the revelation that it had overstated its expected half-year profits by £250m caused alarm among investors.

Tesco has asked a growing number of senior executives to step aside while internal investigations into the accounting irregularity take place.

The Financial Conduct Authority has also confirmed it is investigating the issue.

- Published14 October 2014

- Published2 October 2014

- Published1 October 2014

- Published1 October 2014