Has quantitative easing worked in the US?

- Published

One of the biggest economic experiments of our age is coming to an end.

The United States Federal Reserve has called time on "quantitative easing" (QE), a policy that has pumped trillions of dollars into the US financial system.

The jury is still out - and will be for a long time - on whether it has worked.

There are real anxieties about what the consequences will ultimately be.

For now though the Fed's main policy making committee has concluded, external that "there has been a substantial improvement in the outlook for the labor market" and "there is sufficient underlying strength in the broader economy". So, QE is being wound up this month.

It started back in November 2008. The financial system in the US and beyond was still reeling from the failure of the investment bank Lehman Brothers.

There were widespread fears about the wider economic consequences. Were we looking at the prospect of another Great Depression?

In the US the Federal Reserve had almost run out of its traditional ammunition, cutting interest rates. So it embarked on something that was new, at least for the Fed, namely QE.

Did the Fed's QE policy help drive the economic recovery in the US?

So what is it? Instead of reducing the price of money - that is, cutting interest rates - the Fed increases the quantity of money. It does that by going into the financial markets to buy assets and it creates new money to pay for them.

The Fed has focused on buying two types of assets: government debt or Treasury bonds, and assets backed by home loans.

The next question is: how is it supposed to work?

The first step is the impact on the price of the type of assets the Fed buys. More demand (from the Fed) raises the price.

To put it another way, there is less supply of these assets available for everyone else, which also tends to raise their price.

Then many of the sellers of these assets use the money to buy something else, pushing the prices of those other assets up too.

That in turn has implications for interest rates, external. Bonds are a kind of IOU, a promise to pay certain sums of money in the future. Governments and some companies use them to borrow money. They sell them in the financial markets. The higher the price they get the lower the interest rate they are in effect paying.

If it all goes to plan that effect can filter through the economy and reduce interest rates for many borrowers.

John Williams, a senior Fed official spelled it out in a speech in 2012, external and it's worth quoting at some length: "If the Fed buys significant quantities of longer-term Treasury securities or mortgage-backed securities, then the supply of those securities available to the public falls.

"As supply falls, the prices of those securities rise and their yields decline. The effects extend to other longer-term securities.

"Mortgage rates and corporate bond yields fall as investors who sold securities to the Fed invest that money elsewhere.

"Hence, [QE] drives down a broad range of longer-term borrowing rates. And lower rates get households and businesses to spend more than they otherwise would, boosting economic activity."

The aim is to push down interest rates paid by business and households even lower than is possible by using the central bank's own conventional interest rate policies.

It's worth bearing in mind what that conventional policy is in the US. The Federal Reserve has a target for the overnight interest rate on lending between commercial banks - it's called the federal funds rate.

Reducing that does usually affect interest rates for everybody else. But when the target is practically zero as it now is, it can't go lower.

So that's where QE comes in. It provides a tool for getting rates lower for companies and consumers.

While the most important effect is on borrowing costs, QE is also thought to have been responsible for much of the strength of stock markets. Shares are among the assets that investors have bought with all the new money they have received from the Fed.

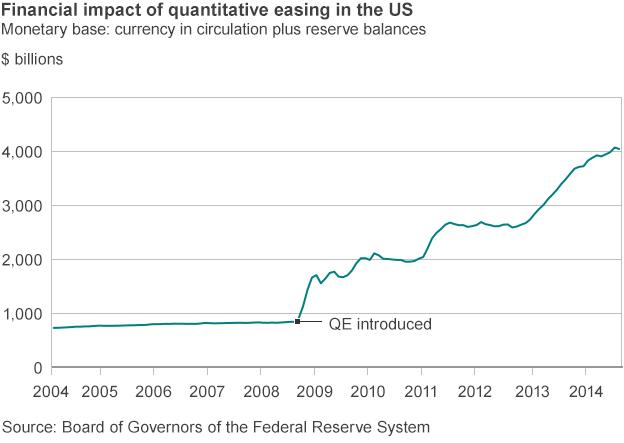

The graph highlights the impact of the Fed's QE programme. It shows the changing level of what is called the monetary base. It's made up of cash and "reserves", money held by commercial banks at the Federal Reserve. Before the financial crisis it grew steadily, but then increased dramatically from late 2008 as the Fed created new money as it sought to stimulate the US economy.

What impact?

So that's what QE is. But has it worked? Its supporters say it has kept interest rates low for households and firms, stimulated job creation and saved the US economy from a much more severe downturn, even another Great Depression.

Critics say it could lead to a new financial crisis, raging inflation and has punished responsible savers. So let's take those arguments, starting with the case for QE.

Establishing the impact is not a straightforward question. It's not a matter of is the US economy in better or worse shape than it was, but is it better or worse than it would have been without QE?

And of course you can't observe what the US economy would have looked like in those hypothetical circumstances.

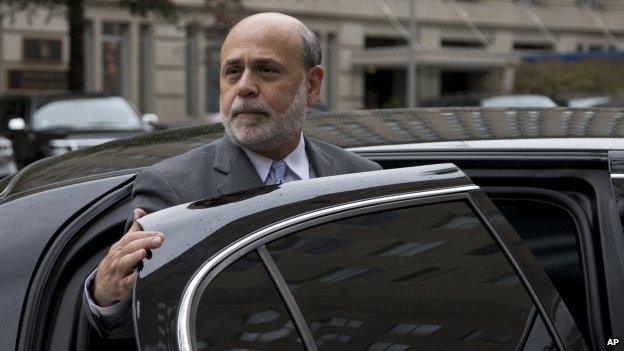

Ben Bernanke believes QE has produced benefits

So economists have tried to work out what difference QE has made.

With that caveat in mind, the former Federal Reserve chairman, Ben Bernanke, said in 2012, external: "There is substantial evidence that the Federal Reserve's asset purchases have lowered longer-term yields and eased broader financial conditions."

He also said that the first two rounds of QE raised economic activity by almost 3% and increased private sector jobs by two million - compared to what would have happened without QE.

Fed official John Williams said later the same year: "We're at long last seeing signs of life in the housing market. Likewise, cheap auto financing rates have spurred car sales. And historically low corporate bond rates encourage businesses to start new projects and hire more workers."

Having said that, QE has not given the US a particularly strong recovery. It has been weaker than many previous post-recession rebounds.

Nonetheless Roger Bootle of Capital Economics thinks it was worthwhile. He wrote, external: "I suspect that in the US it (QE), and the other support programmes, prevented a complete disaster."

So that's the case for the defence.

But there are plenty of opponents with quite a catalogue of criticisms.

One concern about QE is that it could lead to higher inflation, meaning higher prices for consumers

A recurrent theme is the idea that QE creates a danger of surging inflation. The policy involves creating new money - an awful lot of a particular type of money - and there is a long history of economic theory that argues that rapid increases in the money supply eventually leads to higher inflation.

At this point it's important to note what type of money the Fed has been creating. It's called reserves - money held by commercial banks in accounts at the central bank.

In some circumstances increasing reserves can lead banks to lend more to the public, which creates new money in their accounts.

But this time the increase in reserves did not translate into anything like as large an increase in money in the hands of the public and inflation has so far remained relatively subdued.

Inflation pressure

Prof Martin Feldstein, external of Harvard University says the risk is that banks might in the future use their reserves to expand lending to firms and households, which would increase the money supply and add to inflationary pressure. But he also says the Fed has options to prevent higher inflation.

Some, including some Fed insiders, are worried that it will be difficult to get it right. One recently retired Fed economist warned of a serious inflation risk, external.

Prof Allan Meltzer, external of Carnegie Mellon University supports the first stages of QE but says "the benefits ended long ago".

He worries that by buying government debt or bonds, the Fed is in effect financing what he calls outsize deficits: "Sooner or later the results are inflation, always and everywhere."

Prof John Cochrane, external of Chicago University has another criticism. He describes QE as a policy that creates a lot of noise but no real effect.

It has no stimulative effect, but nor is it inflationary. But it's not harmless, he says. It distracts attention from what he considers the real obstacles to growth - tax and regulatory barriers.

Borrowers gained from a combination of low interest rates and QE

Then there is the idea that QE punishes savers, by driving down interest rates, while it rewards borrowers, some of them irresponsible ones.

A study by the consultants McKinsey, external, published in 2013, found that the combined effect of low Fed interest rates and QE had cost US households $360bn (£220bn).

By and large younger households - who are more likely to be borrowers - had gained; older ones - with more savings - had lost.

Other estimates, external have put the figure even higher. The Fed's policies have even been described, external as a "war on seniors".

There are also concerns about the impact of QE on financial markets. Has it created a danger of another bout of financial instability?

The International Monetary Fund referred, external to that possibility in a recent report.

Fuelling risk

The IMF accepted that policies such as QE were important for economic recovery but it also warned of a danger of "excessive financial risk taking".

Low interest rates make it cheap to borrow money to invest in financial assets.

They also encourage investors to look for alternative assets that have higher returns, which are usually also riskier.

They may be bonds issued by less creditworthy businesses, or shares in companies with uncertain prospects.

Quantitative easing also had an impact on other major currencies

That brings us to another criticism. One alternative chosen by many US investors seeking something more lucrative was to put money into emerging markets.

In the process they drove up the value of many of the currencies. Many people in those countries worried that they would be made less competitive as a result. In 2010 the Brazilian Finance Minister, Guido Mantega, called it a "currency war".

More recently that concern was turned on its head after the Fed signalled last year that QE was likely to be gradually "tapered" or discontinued.

There were some episodes in which emerging market currencies fell markedly as investors pulled money back to the US anticipating the end of QE and the prospect of higher interest rates.

The concern about competitiveness was overtaken by worries that falling currencies in emerging economies might aggravate inflation.

QE is one, perhaps the most important, of a range of tools often described as "unconventional monetary policies". That is quite an understatement. Throwing huge sums of money at the financial markets is something that would normally bring a central banker out in a cold sweat.

But the financial crisis was such a challenge that it led them to use tools they would normally keep locked away.

One former Fed official once put it like this: "You don't want to be found dead after a shoot-out with unused ammunition."

So QE may be ending, but we can be sure the debate about its impact will not. Has it saved the US, and perhaps the rest of us, from economic disaster?

Or has it sowed the seeds for the next financial crisis?

Quantitative Easing: Step by step

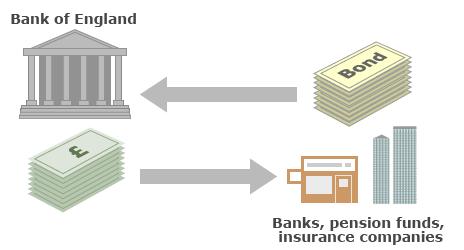

First, with the permission of the Treasury, the Bank of England creates lots of money. It does this by just crediting its own bank account.

The Bank of England wants to use that cash to increase spending and boost the economy so it spends it, mainly on buying government bonds from financial firms such as banks, insurance companies and pension funds.

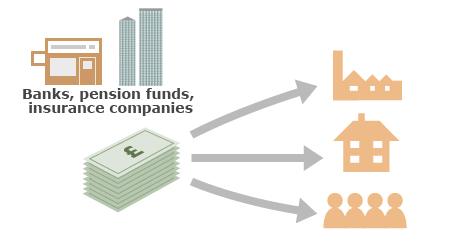

The Bank buying bonds makes them more expensive, so they are a less attractive investment. That means companies that have sold bonds may use the proceeds to invest in other companies or lend to individuals.

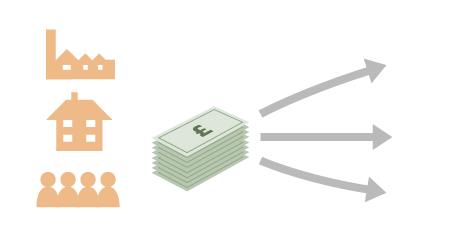

If banks, pension funds and insurance companies are more enthusiastic about lending to companies and individuals, the interest rates they charge should fall, so more money is spent and the economy is boosted.

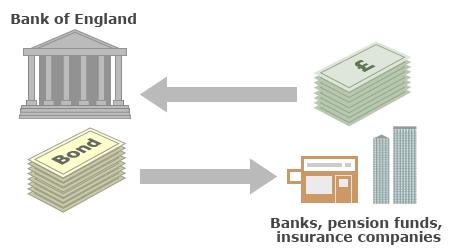

Theoretically, when the economy has recovered, the Bank of England sells the bonds it has bought and destroys the cash it receives. That means in the long term there has been no extra cash created.