Payday loan charges cap announced by FCA

- Published

The new rules will come into force in January, the FCA says

A cap on the amount that payday lenders can charge their customers has been announced by the City regulator.

Payday loan rates will be capped at 0.8% per day of the amount borrowed, said the Financial Conduct Authority (FCA)., external

In total, no one will have to pay back more than twice what they borrowed, and there will be a £15 cap on default charges.

The loan restrictions will start from January, the regulator said.

"For people who struggle to repay, we believe the new rules will put an end to spiralling payday debts," said FCA chief executive Martin Wheatley.

FCA's Martin Wheatley: It "may be the case" there will be no High Street payday lenders in a year's time

"For most of the borrowers who do pay back their loans on time, the cap on fees and charges represents substantial protections," he added.

The price cap plan - which includes both interest and fees - remains unchanged from proposals the regulator published in July.

'Tighter checks'

The confirmed measures will see:

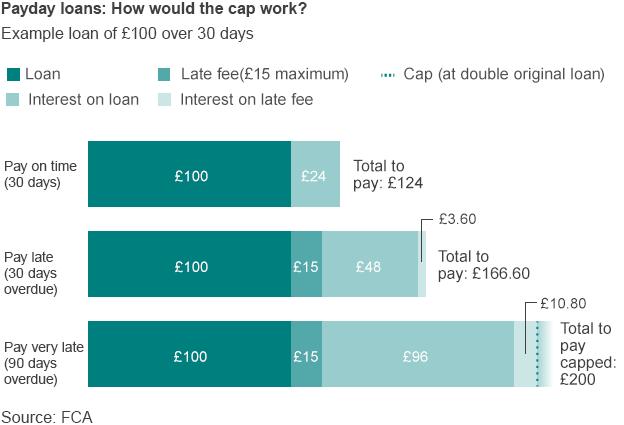

Initial cap of 0.8% a day in interest charges. Someone who takes out a loan of £100 over 30 days, and pays back on time, will therefore pay no more than £24 in interest

A cap of £15 on the one-off default fee. Borrowers who fail to pay back on time can be charged a maximum of £15, plus a maximum of 0.8% a day in interest and fees

Total cost cap of 100%. If a borrower defaults, the interest on the debt will build up, but he or she will never have to pay back more than twice the amount they borrowed

Russell Hamblin-Boone, chief executive of the Consumer Finance Association, said the payday loans industry had already put in place higher standards of conduct.

"We've restricted, for example, extending loans, rolling over loans, [and] we've got tighter checks on people before we approve loans," he told BBC Radio Four's Today programme.

"This [cap], if you like, is the cherry on a rather heavily-iced cake," he said.

The £2.8bn industry was expected to shrink as a consequence of the cap, which could make people vulnerable to loan sharks, he added.

"We'll inevitably see fewer people getting fewer loans from fewer lenders," Mr Hamblin-Boone said. "The fact is, the demand is not going to go away. What we need to do is make sure we have an alternative, and that we're catching people, and that they're not going to illegal lenders."

Zoe Conway, Reporter, BBC Radio 4 Today: The view from Byker, Newcastle

In the High Street in Byker, there are pawn shops, and brightly coloured Money Shops and Cash Converters. It does not take long to meet someone struggling with debt.

Kevin, behind on a loan from a doorstep lender, says people have very few options. "I've actually been approached in the street," he says. "It was one of those 'legs broke if you don't pay' sort of things."

There is concern in this community that if it gets harder for people to access payday loans, the loan sharks will take over. That is certainly the view at the Byker Moneywise Credit Union. They offer payday loans at much lower rates but few people locally know about them and, admits manager Christine Callaghan, the Union is not big enough to meet the demand for short-term loans.

At The Big Grill, the owner, John, is making bacon sandwiches. He is worried that people may have to resort to stealing to make ends meet. "They'll turn to crime to get what they want especially for their kids," he says.

It is a view shared by resident Alison who thinks the government needs to step in to give people more options and better places to turn to.

Responsible lending

Mr Wheatley, of the FCA, said that the regulator's research had shown that 70,000 people who were able to secure a payday loan now would not be able to do so under the new, stricter rules. They represent about 7% of current borrowers.

However, he disputed the industry's view that many of these people would be driven into the arms of illegal loan sharks. He said most would do without getting a loan, some would turn to their families or employers for help, and only 2% would go to loan sharks.

He added that he wanted to see a responsible, mature industry for short-term loans.

Gillian Guy, chief executive of Citizens Advice, said: "People who are in a position to borrow need a responsible short-term credit market. A vital part of this is greater choice. High Street banks should seize the opportunity to meet demand and offer their customers a better alternative to payday loans.

"The FCA should monitor the cap, including whether it is set at the right level, to make sure it is working for consumers. They must also keep a close eye on whether lenders are sticking to the rules."

Earlier this year, the government legislated to require the FCA to introduce a cap on the cost of payday loans. Chancellor George Osborne said the decision would "make sure some of the absolutely outrageous fees and unacceptable practices are dealt with".

Meanwhile, Cathy Jamieson, Labour's shadow financial secretary to the Treasury, said she was glad that action was being taken.

"However, we believe these changes will need to be regularly monitored to ensure they are effective. That is why we want to see a review by the end of 2015 - much earlier than is currently being recommended by the FCA," she said.

- Published9 October 2014

- Published2 September 2014

- Published14 July 2014

- Published11 July 2014