Carney puts bankers' pay in spotlight after misconduct shockwaves

- Published

- comments

Bank of England governor Mark Carney says it is time to think about tougher sanctions on bankers who cheat the system

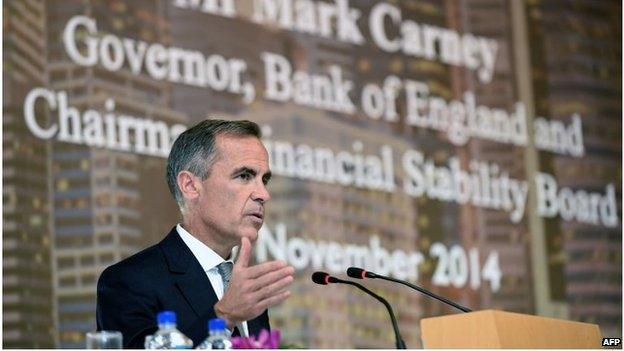

In a speech in Singapore in the early hours of this morning, the Governor of the Bank of England has said it is time to look at clawing back the overall pay of bankers in the event of wrong-doing, not just the bonus element.

In his first major intervention since the revelations about the fixing of foreign exchange markets last week, Mark Carney argued that new mechanisms were needed to "help re-build trust in financial institutions".

That is going to be a long process. One banking chief executive I spoke to last week said that the forex revelations had been "a disaster" for the sector.

He said that rigging the market should be treated no differently from a bank cashier stealing money from the till.

And that there should be criminal sanctions.

'Fundamental change'

Mr Carney is also clear in his speech - the public will never have faith in the banking system unless behaviour changes.

"[It] is far from straightforward when, even six years on from the crisis and public bailouts, triggers for public opprobrium are plentiful," he said of the trust issue.

"Last week, the UK's Financial Conduct Authority, US CFTC and Swiss FINMA fined six banks $3.3bn for misconduct in FX markets: misconduct that went on long after banks had already been fined for abusing interbank interest rate benchmarks."

The last sentence is the key. Not only were the fines for behaviour that happened after the fines on interest rates, they came after major compensation pay-outs for the mis-selling of payment-protection insurance, interest rate swap mis-selling to small businesses and, of course, the disaster of the financial crisis itself.

"The repeated nature of these fines demonstrates that financial penalties alone are not sufficient to address the issues raised. Fundamental change is needed to institutional culture, to compensation arrangements and to markets."

Barrels not apples

And then the knock-out blow.

"The succession of scandals means it is simply untenable now to argue that the problem is one of a few bad apples. The issue is with the barrels in which they are stored."

Mr Carney, speaking as the head of the Financial Stability Board, says that pay is one of the driving factors of a culture that puts quarter-on-quarter reward ahead of long term stability and ethical behaviour.

"Compensation schemes overvalued the present and heavily discounted the future, encouraging imprudent risk taking and short-termism," he said.

"Standards may need to be developed to put non-bonus or fixed pay at risk. That could potentially be achieved through payment in instruments other than cash."

'Risk takers'

One example of a payment "other than cash" is a performance bond linked to the bank's future trajectory. If bad behaviour is uncovered and fines levied, holders of the bond would face a financial penalty.

The idea has been raised by William Dudley, the president of the Federal Reserve Bank of New York. He has said , externalthat senior managers and all "major risk takers" in a bank could receive the bond as part of their remuneration.

Mr Carney's intervention goes to the heart of the system of bank pay which is "incentive" based. That means, as a proportion of overall pay, the fixed amount is a relatively low.

Bankers have to hit activity targets to receive their end of year bonus. This can encourage the wrong type of risk taking and, as we saw in the case of forex manipulation, collusion to make the numbers stack up in the banks' - and the traders' - favour.

Threat

As the Governor of the Bank of England, Mr Carney is the man with overall responsibility for financial stability in the UK. He told me when I interviewed him last week in Basel, Switzerland, that misconduct was a threat to the perception and operation of the markets.

He says the structures are now in place to end "too big to fail".

Today, in this important speech, Mr Carney has made it clear the next major issue for the financial sector to tackle - pay that is structured to incentivise bad behaviour.