Hooray for cheap oil

- Published

- comments

I am not sure what the opposite of red lights flashing on the dashboard would be (maybe you won't want to get in a car with me), but whatever that might be, it's happening now.

Or to put it another way, there is something positive going on for most of the world's people - which is that the remarkable fall in oil prices is continuing.

One important indicative price, that of Brent Crude, fell a further 1.7% this morning to $68.40 a barrel - which means the price is now 40% below its peak in June.

Crikey.

And the price of West Texas Intermediate is down to $65, a price we haven't seen since the middle of July 2009, when the world was gripped by its worst economic slump since the 1930s.

What's going on?

Well, demand for oil has been falling - because of the eurozone's stagnation, Japan's recession and China's slowdown - while output has been rising, largely thanks to America's shale boom.

So an oil glut has been created, which was reinforced last week when the oil producers of OPEC - to the great surprise of many - didn't cut their output target of 30 million barrels a day.

Anyway, the important point is that an oil price fall represents a transfer of cash into the pockets of consumers, via lower prices for petrol and all goods and services where energy is a big component of the price.

Lower oil prices means more cash for consumers to spend elsewhere

Consumers have a habit of spending this freed-up cash, which then stimulates economic activity and growth.

There are of course losers - the huge oil companies, governments and plutocrats in oil-rich countries, from Saudi to Russia and Nigeria.

But their marginal propensity to spend is less than that of consumers. So the fall in producers' income and profits is less harmful for the world.

What's the net benefit to the global economy of the tumbling oil price? Well, economists estimate that a 40% fall in the oil price, if sustained, would add something over 0.5% to global economic growth, perhaps as much as 0.8%.

Hooray.

That said, whenever there is such a pronounced change in the price of such an important item, the redistribution effects can have dangerous political and economic consequences.

The impact, for example, on oil-dependent and financially-stretched Venezuela, Iran, Nigeria and Russia is likely to be pretty dire. If nothing else, they'll have to slash public spending, if they're to avoid a disastrous deterioration from their already strained public finances.

It would not be a surprise - and wouldn't be the first time - that a dramatic change in the oil price led to major social upheaval in an oil-rich state.

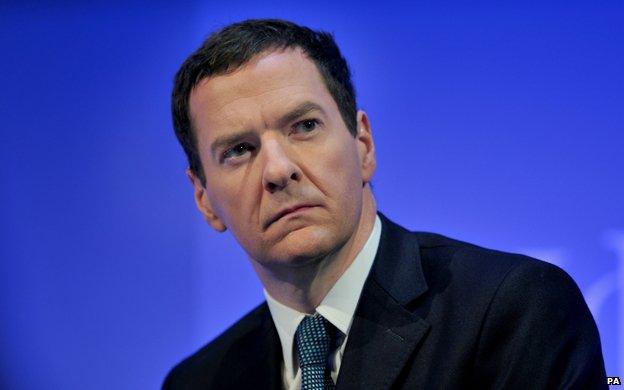

The price fall is not necessarily good news for George Osborne

But taking the narrow short-term view of what helps you and me right now, the falling oil price will put vastly more money in your pocket than anything the chancellor could dream of doing in his autumn statement on Wednesday.

Apart from anything else, and as I said on News at Ten last night and here, there's nothing in his kitty.

And the oil price fall is bad news for him personally, in a fiscal sense, because it erodes precious oil-related taxes.