How far will Osborne go on the 'Google tax'?

- Published

At the Conservative Party conference in the autumn, the Chancellor could not have been clearer.

"You are welcome here in Britain with open arms," George Osborne said to technology companies including Google, Amazon and Facebook.

And indeed they are, according to their fans, for the thousands of often well paid jobs they create. And also for the support they give to small tech start-ups in places such as "silicon roundabout" in east London.

But, the Chancellor also had a warning.

"While we offer some of the lowest business taxes in the world, we expect those taxes to be paid."

Many technology companies have been criticised for paying small amounts of tax in the UK despite Britain being one of the most important online markets in the world.

UK consumers generate billions of pounds of revenue for technology businesses. We love Google, Facebook and Amazon and use them with a passion.

But, as those same companies never tire of telling you, corporate taxes are still low, because the system does not tax sales, it taxes profits.

And those profits are fiendishly difficult to pin down.

Intellectual property payments to holding companies, the movement of sales activity to lower tax jurisdictions and the cost of licensing fees to holding companies all confuse the picture and allow firms with very mobile business models (such as in the technology sector) to be highly tax efficient.

Eric Schmidt, the chairman of Google, said it was his financial duty to his shareholders to structure the company in such a way.

Abuse of trust

Others, though, argue that the law needs to change so that complex arrangements are cleared up and profits made in a country cannot be "diverted".

Mr Osborne has said he agrees.

"If you abuse our tax system, you abuse the trust of the British people," Mr Osborne continued in his speech to the Conservative conference.

"My message to these companies is clear. We will put a stop to it. Low taxes, but low taxes that are paid."

It was soon being briefed around the bars of Birmingham, where the conference was taking place, that the Chancellor was planning a "Google tax".

That is, a tax on technology companies that will mean them paying more in the UK rather than diverting profits to other countries with lower tax rates.

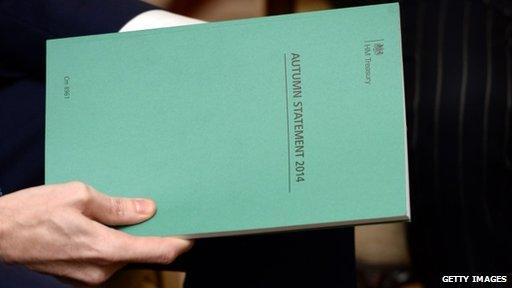

Indeed, it was soon clear that such a move was to be a centre piece of Wednesday's Autumn Statement.

One senior Government figure told me last month that it would be the single most important business announcement of the day.

Well, we will soon find out just how far the Chancellor has progressed on this issue.

Because taxing international businesses is harder than it might first appear.

Global deal

The problem is that tax on global corporations needs international agreement. And the process for achieving that is not yet completed.

The OECD group of leading economies, including the UK and Germany, are heading the drive for a global deal.

A policy paper in September looked at mechanisms for unwinding "hybrid mismatches" which companies use to avoid in-country tax.

The Government has said it wants to be one of the first to legislate when the rules are finalised, probably next year.

So, today, we are likely to hear more details of that process. And, possibly, plans for legislation in the next Parliament.

Which means that a new flow of taxes may not start coming the Treasury's way until 2017.

In the Statement, there could also be an announcement on a new requirement for companies to detail revenue and tax payments made country by country.

That way, the public at least has some idea of the tax contribution businesses make to the UK.

Companies such as Vodafone already do that, and Treasury officials have made it clear they like the model.

Three months ago Mr Osborne said he was going to act. Watch today's Autumn Statement closely, and see how much he is actually able to achieve.

- Published26 November 2014