Stamp duty changes: How will they work?

- Published

The new stamp duty system will be similar to that being introduced in Scotland

Stamp duty on home purchases is to be reformed from midnight on Wednesday, along the lines of the system due to be introduced in Scotland, the chancellor has announced.

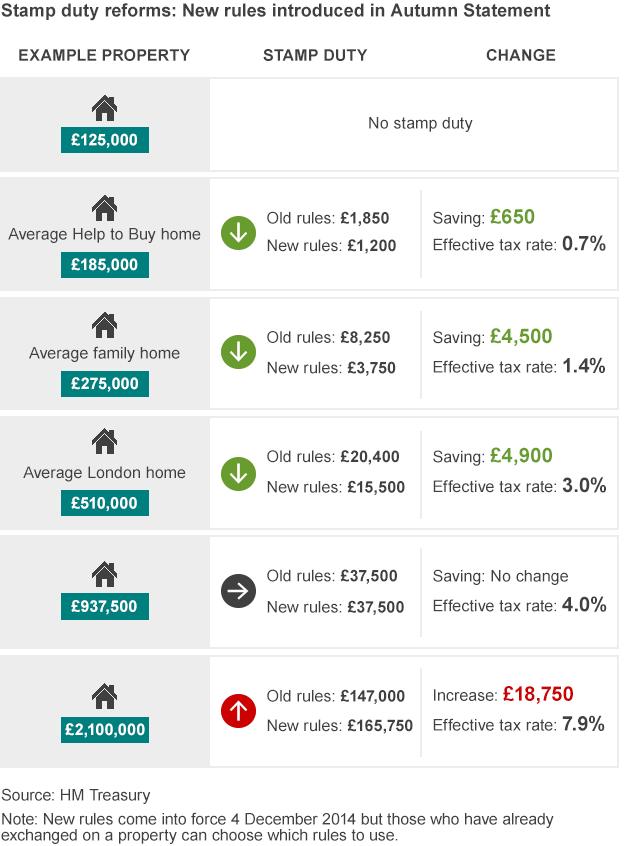

George Osborne said 98% of homeowners in England and Wales would pay less after the changes than they do under the current system.

Only people who buy homes worth more than £937,000 will pay more in tax.

"It's time we changed this badly-designed tax on aspiration," Mr Osborne told MPs.

So how will these changes work?

How does the system work at the moment?

Stamp duty, which currently operates throughout the UK, charges successively higher rates on the whole of the purchase price. For this reason it is often criticised as a "slab tax". Its structure means there are sudden increases in stamp duty, when the price goes above the next threshold.

For example, someone buying a home for £250,000 would currently pay £2,500, or 1%, in stamp duty. But if the price was £1 more, they would pay an extra £5,000, as they then pay 3% on the whole purchase price.

How will the new system be different?

From midnight on 3rd December, the new rates of stamp duty will only apply to the amount of the purchase price that falls within the particular duty band, making it more like income tax.

In other words, someone buying a house for £200,000 will pay nothing on the first £125,000, and then 2% of the next £75,000, giving them a bill of £1500. Previously they would have paid 1% on the total purchase price, giving them a bill of £2,000. Thus although the percentage rates appear higher in some cases, the overall charge will mostly be lower.

The new rates will be

Up to £125,000 : 0%

£125,001 to £250,000 : 2%

£250,001 to £925,000 : 5%

£925,001 to £1.5m : 10%

Above £1.5m : 12%

Someone buying an family home for an average price in England and Wales will now pay £4,500 less in stamp duty. The new system will also smooth out the steps - or sudden jumps - in existing stamp duty thresholds.

Will it be the same as the Scottish system?

From 1 April 2015, stamp duty in Scotland is being replaced by Land and Buildings Transaction Tax (LBTT). Until that date, the new stamp duty rates will apply in Scotland too. The new system in England and Wales will be similar to LBTT, with buyers only charged the higher rates on the portion of the property price that falls within that band.

Under Scotland's LBTT, people buying houses priced below £324,280 will pay less than under the stamp duty system as it existed before 3 December. Those spending more than that will be worse off.

What will buyers pay?

The government has created a stamp duty calculator, external to help buyers, but some examples are listed here:

What will the rates be in Scotland?

The rates for LBTT in Scotland will be lower than the equivalent stamp duty in England and Wales. Scottish purchasers will start paying tax at £135,000, whereas buyers elsewhere in the UK will pay from £125,000. As in England and Wales, richer buyers will lose out under the new system, and more modest buyers will benefit. From 1 April, the LBTT rates will be

Up to £135,000 : 0%

£135,001 to £250,000 : 2%

£250,001 to £1m: 10%

£1m+: 12%