Autumn Statement: Government borrowing forecast raised

- Published

The government is expected to borrow more money this year than had previously been predicted.

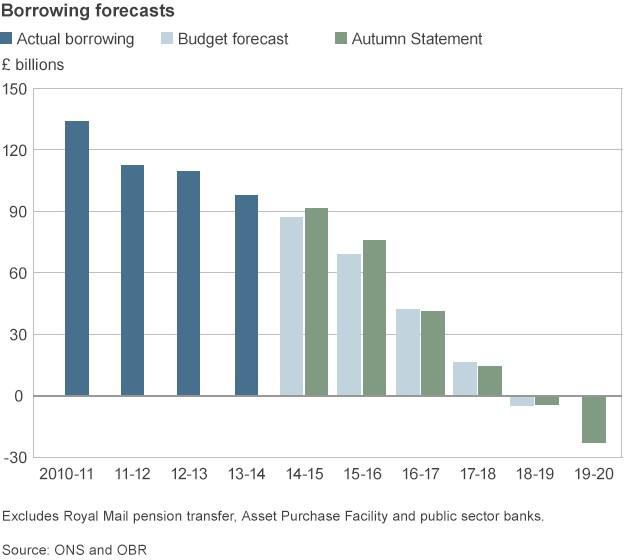

The Office for Budget Responsibility (OBR) has raised its borrowing forecast for the current financial year from £86.6bn to £91.3bn, which is still below last year's total of £97.5bn.

The figure was announced in Chancellor George Osborne's Autumn Statement.

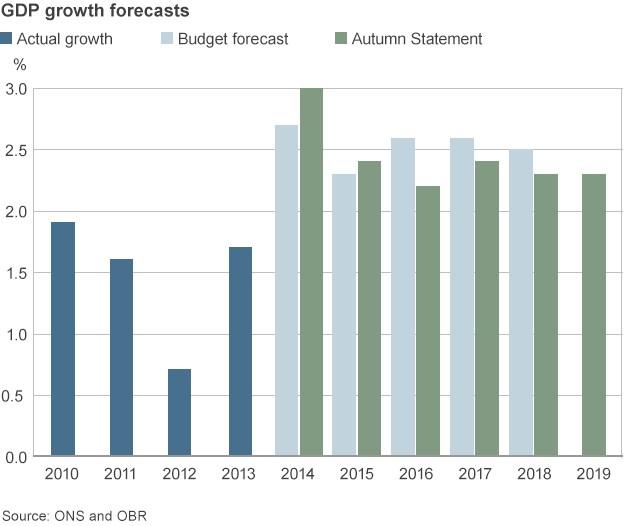

The OBR also raised its forecast for economic growth this year from 2.7% to 3.0%, and from 2.3% to 2.4% next year.

The rise in the growth forecast brings the independent OBR into line with the consensus in the City, although it is still below the Bank of England's estimate.

While the OBR has raised its growth forecast for the next two years, it has cut it for the following three years.

Spending cuts

The rise in the borrowing forecast is a result of the surprisingly low tax take.

Many analysts had been expecting the borrowing forecasts to rise by more because, as the chancellor conceded, "tax receipts have deteriorated" by more than the OBR had predicted.

Mr Osborne said the biggest factor keeping borrowing down was that the amount of interest being paid on the debt was lower than had been expected.

But there were stark warnings from the OBR in its report, external accompanying the Autumn Statement of the amount of spending cuts still to come from the government.

It said that the government's overall plan for spending on public services was to reduce it from £5,650 per head in 2009-10 to £3,880 per head in 2019-20.

The OBR warned that only about 40% of that cut would be made during the current Parliament, with the remaining 60% still to come in the next one.

"Total public spending is now projected to fall to 35.2% of GDP in 2019-20, taking it below the previous post-war lows reached in 1957-58 and 1999-00 to what would probably be its lowest level in 80 years."

The OBR also said: "Despite strong economic growth, the budget deficit is expected to fall by only £6.3bn this year to £91.3bn, around half the decline we expected in March.

"That would be the second smallest year-on-year reduction since its peak in 2009-10, despite this being the strongest year for GDP growth."

The government was still set to miss its target of having net debt fall as a share of GDP in 2015-16, the independent forecaster said. It expected net debt to rise by 0.8% of GDP in that year, when it will peak at 81.1%.

George Osborne MP: "The deficit is falling this year and every year"

In his response to the Autumn Statement, shadow chancellor Ed Balls said: "Over two years [Mr Osborne] has revised up borrowing by £12.5bn."

"This means the chancellor will have borrowed in this Parliament £219bn more than he planned in 2010."

Inflation forecast

The increase in the borrowing forecast had been expected because the government borrowed £64.1bn in the first seven months of the financial year, an increase of £3.7bn from the same period last year.

The forecast for borrowing next year has been raised from £68.7bn to £75.9bn, but the predictions for the years after that have improved.

The OBR expects inflation measured by the consumer prices index (CPI) of 1.5% this year, 1.2% next year and 1.7% the year after. It had previously said that CPI would only fall slightly below the Bank of England's forecast rate of 2.0% this year before returning to that level.

The latest figures from the Office for National Statistics (ONS) show that the interest paid on government debt in the year to the end of October came in at £49.2bn, down from £50.4bn in the previous 12 months, despite rising debt.

Lower inflation forecasts also mean the government expects to have to make lower welfare payments and lower uprating on public sector pensions.

Some analysts had also suggested that the point at which the government finances moves into surplus could be delayed by a year, but in fact the surplus for 2018-19 has only been reduced from £5bn to £4bn, with a surplus of £23bn predicted for 2019-20.