Co-op Bank fails Bank of England stress tests

- Published

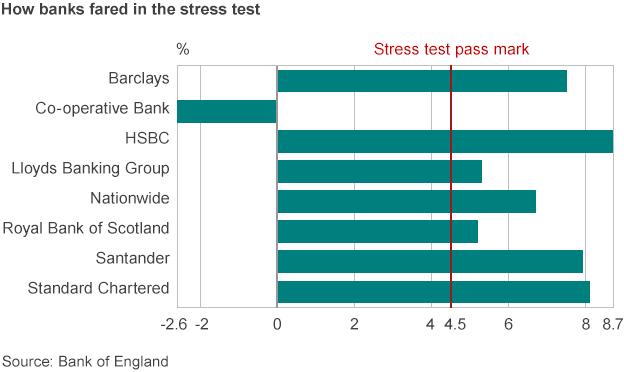

The Co-operative Bank has failed a "stress test" by the Bank of England that assessed major UK lenders' ability to withstand another financial crisis.

A further two banks - Lloyds Banking Group and Royal Bank of Scotland - were found to be at risk in the event of a "severe economic downturn".

The Bank of England tested the lenders' resilience to a 35% fall in house prices, and a 30% drop in the value of the pound, among other factors.

Five major banks passed the test, external.

The results show that the banking system is "significantly more resilient", said Bank of England governor Mark Carney, and that the "growing confidence in the system is merited".

"This was a demanding test," he added.

Stress test scenario

Sterling falls by about 30%

House prices fall by 35%

Bank rate rises to 4.2%

CPI inflation peaks at 6.6%

Unemployment rises to nearly 12%

GDP falls by 3.5%

Share prices fall by 30%

In the first test of its kind, the balance sheets of eight UK banks and building societies were assessed by the Prudential Regulation Authority, which is a part of the Bank of England.

HSBC, Barclays, Santander, Standard Chartered and Nationwide all passed.

The doomsday scenario mapped out by the Bank of England included an unemployment rate of nearly 12%, inflation rising to more than 6%, and interest rates rising to 4.2%.

The Bank emphasised that the scenario was "extreme", and was not likely to materialise.

'No surprise'

The Co-operative Bank, which had to be rescued last year after a £1.5bn black hole was found in its balance sheet, was the only bank deemed to require a "revised capital plan".

The chief executive of Co-operative Bank, Niall Booker, said it was "no surprise" that the lender had not passed the test, but said the Bank was on track to "significantly reduce risk-weighted assets".

The Co-op also said that its restructuring plans meant it would not make a profit until 2017, at the least.

The Royal Bank of Scotland (RBS) and Lloyds Banking Group - both of which were bailed out by the taxpayer during the financial crisis - were found to be in need of further strengthening.

The Bank of England official behind the stress tests, Andrew Bailey, told the BBC that while RBS and Lloyds did not actually fail, they were found to be "too close [to vulnerability] for comfort".

But the Bank stopped short of requiring the two lenders to submit new plans, as both are already taking action to reduce risks.

Mr Bailey added that he was not surprised by how RBS and Lloyds fared, and underlined that "we have to bear in mind the major tasks that both banks have had to rebuild their capital positions and their resilience from the depths of the crisis".

Officials were also quick to point out that customers of UK banks need not worry about their deposits, as there is a safety net in place in the unlikely event that any bank, building society or credit union were to go bust.

The Financial Services Compensation Scheme, external protects the first £85,000 of savings per person, per institution.

The Bank of England's stress tests built on similar health checks by the European Banking Authority (EBA) in October.

The EBA found that 24 European banks needed to shore up their finances.

Four UK banks were subjected to the EBA test: Royal Bank of Scotland, HSBC, Lloyds Banking Group and Barclays. They all passed.

The Bank of England will submit UK banks to an annual stress test henceforth.

Analysis: Kamal Ahmed, BBC business editor

The Bank of England has made it clear that its doomsday scenario is not something that it thinks is likely to happen at the moment.

It is an attempt to replicate the bad news piled upon bad news such as occurred in 2008.

And given that the present risks in the economy include a collapse in the oil price and possible deflation in the eurozone, some argue that the Bank is testing the wrong thing.

- Published16 December 2014

- Published1 December 2014

- Published26 October 2014