'Strong case' for abandoning inflation measure

- Published

There is a strong case for abandoning the Consumer Prices Index (CPI) as the headline measure of inflation, according to Institute for Fiscal Studies head Paul Johnson.

He was commissioned to review, external the measures of inflation for the UK Statistics Authority (UKSA).

Mr Johnson suggests replacing CPI with CPIH, a measure that includes owner occupiers' housing costs.

His recommendations are not binding on the government or the UKSA.

The authority is now expected to launch a consultation on the report and respond to it later in the year.

The CPI is one of the most important indicators for the economy, because the Bank of England's interest rate-setting Monetary Policy Committee's job is to keep CPI within one percentage point either side of its 2.0% target.

Measures of inflation

CPI - currently the headline rate of inflation, comparable with other European countries

CPIH- CPI with an added measure of owner-occupier housing costs

RPI - the old measure of inflation, now discredited due to problems with methodology

RPIJ - RPI adjusted to solve the methodological problems

Mr Johnson also suggests that the government should move away from using the Retail Prices Index (RPI) for any reason as soon as possible.

It is currently used to determine how much regulated train fares can rise as well as the interest paid on some government bonds and student loans.

RPI had its national statistic status removed in 2013, but at the time it was decided that the problems with the way it is worked out should not be resolved because that would be moving the goalposts on existing things like bonds and some private sector pension schemes.

'Unfortunate'

RPIJ was introduced as a new version of RPI without the calculation problems, but Mr Johnson recommends stopping the production of RPIJ and that having too many measures of inflation is confusing.

On the other hand, at a news conference he said that continuing to pay interest on government bonds using the discredited formulation for RPI instead of changing to RPIJ, a method that meets international standards, was costing the UK £2bn a year.

He said it was "unfortunate that we are where we are" but that it would be difficult to unpick current legal obligations.

He added that there was little demand for index-linked bonds that were not based on RPI because most private sector pensions were still linked to RPI.

While he says that government and regulators should work towards ending the use of the RPI as soon as possible and that it should then stop being produced, he points out that some government bonds currently based on RPI do not mature until 2068, which means it will be difficult to withdraw it any time soon.

'Odd'

In the most recent set of inflation figures, external, CPI and CPIH both showed inflation of 1.0%.

But, like RPI, CPIH currently has its designation as a national statistic suspended because of concerns about the way it is calculated.

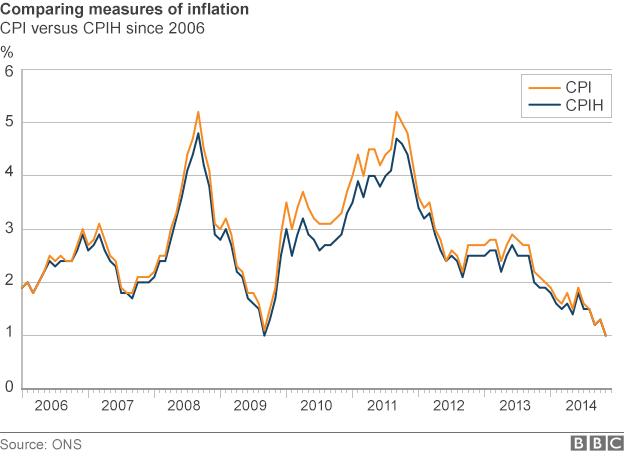

Since it started being calculated in 2006, CPIH has always been either the same as or slightly below CPI. It has never been more than half a percentage point below CPI. But Mr Johnson said he was surprised that CPIH had been so close to CPI, that there may be greater differences in the future and that, when measuring inflation, "it is odd just to leave out owner-occupied housing".

Research conducted as part of the review found that households with the lowest levels of spending had experienced significantly greater inflation recently than those with higher spending.

The review recommended that the Office for National Statistics should begin producing an annual report looking at the impact of inflation on different groups.