Canary Wharf owner Songbird Estates scorns Qatar bid

- Published

The owner of London's Canary Wharf complex, Songbird Estates, has advised its investors to reject a new Qatari-led bid worth £2.59bn.

The offer of 350 pence per share for Songbird, which owns 69% of Canary Wharf Group, undervalues the firm, it said.

Qatar Investment Authority (QIA) and US investor Brookfield Property Partners made the offer.

Shareholders have until 29 January to accept or reject it.

QIA owns 29% of Songbird. It will have to persuade the next three biggest shareholders, New York-based Simon Glick, sovereign wealth fund China Investment Corp and Morgan Stanley, who own more than 50% between them and are still evaluating the offer, Songbird said.

The move is the latest in a series of offers from QIA for the firm.

"The board remains unmoved in its view that the offer does not reflect the full value of the business, its unique operating platform and its prospects," said David Pritchard, the chairman of Songbird.

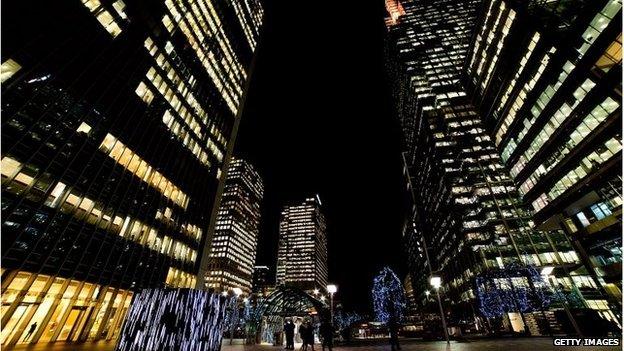

Canary Wharf was established 25 years ago as the new financial district in London, and is home to some of the world's biggest banks including HSBC and Barclays.

In the UK, Qatar owns Harrods, Chelsea Barracks and the Shard, Europe's tallest skyscraper.

QIA was founded in 2005 by the state of Qatar to help its economy by investing in a diverse array of businesses, outside of the country's huge oil and gas resources.

- Published7 November 2014

- Published5 December 2014