UK inflation rate falls to 0.5% in December

- Published

Bank of England governor Mark Carney spoke to the BBC's Economics Editor Robert Peston

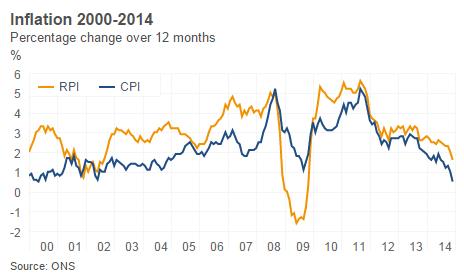

The UK inflation rate fell sharply to 0.5% in December, the joint lowest on record, official figures show.

Inflation as measured by the Consumer Prices Index, external fell from 1% in November to its lowest rate since May 2000, helped by cheaper fuel prices.

Low inflation could mean lower interest rates for longer, Bank of England governor Mark Carney told the BBC.

However, he said he still expected rates to "move up over the course of the next couple of years".

A fall of inflation below 1% triggers a letter of explanation from Mr Carney to the chancellor.

This is because the CPI rate is more than one percentage point away from the Bank's 2% target.

The Office for National Statistics (ONS) also said that the Retail Prices Index (RPI) measure of inflation fell to 1.6% from 2%.

The ONS said that in addition to falling fuel prices, the drop in inflation was also due to the rises in gas and electricity prices in December 2013 falling out of the equation.

George Osborne said it showed the government's economic policy was on track

Economists said that a further fall seems likely, bringing the UK closer to the scenario playing out in the eurozone, where deflation has become a problem for policymakers.

Paul Hollingsworth, of Capital Economics, said inflation could fall to about 0.2% in February, and that an outright drop in prices was possible.

Martin Beck, senior economic advisor to the EY Item Club, said a negative reading in February "is now looking more likely than not" as the impact of further oil price falls had yet to feed through.

'Giant tax cut'

Chancellor George Osborne hailed the fall in the inflation rate as good news. He tweeted: "Inflation is 0.5% - lowest level in modern times. Welcome news with family budgets going further & economic recovery starting to be widely felt."

Danny Alexander, Liberal Democrat chief secretary to the Treasury, said lower inflation was acting "like a giant giant tax cut for the economy".

But Labour's shadow Treasury minister, Shabana Mahmood, said the squeeze on wages and living standards meant working people "are £1600 a year worse off under this government... And falling energy costs are still not being fully passed on to consumers".

Keeping interest rates at record low levels for longer could be a way of mitigating low inflation, Mr Carney told the BBC.

But he stressed that the Bank still expected to raise rates gently within the foreseeable future.

"It will be an environment, most likely, that interest rates start to increase and move up over the course of the next couple of years," he said.

Inflation calculator

Economists said the issue of when to raise interest rates looked to be off the agenda for the next few months.

Rain Newton Smith, director of economics at the CBI employers' group, said: "With falling inflation rates and subdued earnings growth, we do not see the first rise in interest rates happening any time soon.

"Even by the end of 2016, the stance of monetary policy is likely to remain loose, providing a bit more breathing space for the UK's recovery," she said.

House prices

And Howard Archer, chief UK economist at IHS Global Insight, said it was unlikely there would be a rate rise "for some considerable time to come".

That is despite house prices continuing to rise, according to the ONS.

Data published on Tuesday showed that prices in the year to November rose 10%, with "strong" growth across most the UK.

The ONS said property values rose 0.2% between October and November, taking the average house price to £271,000, just below the all-time high of £274,000 reached last August.

Concerns about a house price bubble last year heightened expectations that the Bank of England would attempt to cool the market by raising rates.

By Anthony Reuben, BBC head of statistics

There has been much discussion in the past week of whether we are using the right measures of inflation, following the publication of an official report on the subject by Paul Johnson, director of the Institute for Fiscal Studies.

If you have filled a car with petrol recently, you may think that a low rate of inflation of 0.5% feels about right, with lower fuel prices also feeding into the delivery costs of food retailers, for example.

Mr Johnson says we quote too many measures of inflation, which is confusing for people. At the risk of upsetting him, it's worth mentioning that core inflation, which tries to capture underlying factors by excluding volatile prices such as food and energy costs, actually rose from 1.2% in November to 1.3% in December.

Analysts said that could reflect the way that some of the discounts usually seen in December were moved back to Black Friday in November, which made December look relatively more expensive.