Headline numbers: What will Mr Carney tell Mr Osborne?

- Published

We're going to have to wait a month to read Bank of England governor Mark Carney's letter explaining why inflation has fallen to 0.5%.

It used to be that the governor had to have a letter ready straight away when it was announced that inflation was more that one percentage point away from the 2.0% target, but now the rules have been changed and the governor gets a month to think about it.

The governor's letter to the chancellor has always been a strange quirk of monetary policy. It feels like something from a bygone age, not something introduced in 1997. I wrote, external five years ago about how bizarre it was that Mervyn King had been forced to write to Alistair Darling to explain why inflation was so high, when one of the key reasons it was so high was that Mr Darling had raised VAT.

This time it is particularly strange because Chancellor George Osborne has been telling everybody what a good thing it is to have inflation at 0.5%.

He tweeted, external: "Inflation is 0.5% - lowest level in modern times. Welcome news with family budgets going further & economic recovery starting to be widely felt".

First of all I need to pick Mr Osborne up on the suggestion that inflation is at its lowest level in modern times. CPI figures are only calculated going back to 1989. There is some wiggle-room in the term "modern times", but classifying anything before 1988 as the olden days seems a bit of a stretch to me.

But the comment raises the question of whether the inflation target should be changed to between 0.5% and 3.0%? And if not, how do you explain why inflation is too low to a chancellor who thinks it is welcome news?

Mr Carney could always crib his letter from Mr Osborne's speech to the Royal Economic Society, explaining that low inflation is ok for the UK because it's driven by external factors such as the oil price.

We also know that Mr Carney is reasonably confident that inflation will soon return to its 2.0% target and allow him and his colleagues on the Monetary Policy Committee to raise interest rates to more normal levels.

When that happens, can we expect Mr Osborne to say that inflation at its target rate is bad news because it means family budgets will go less far?

Anyway, it appears that Mr Carney is expecting that the fall in the price of oil will slow or even stop. The trouble is, the Bank of England's forecasting record is not great.

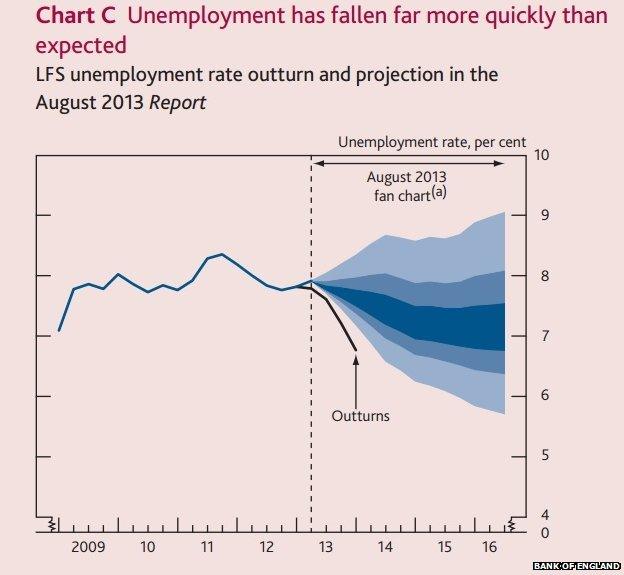

It's not particularly worse than anybody else's record, but talking about it gives a good excuse to reproduce one of my favourite graphs, which shows what happened to unemployment after Mr Carney said that the MPC would not consider raising interest rates until unemployment fell below 7%.

It comes from last August's Bank of England inflation report. The fan is what the Bank considered to be the likely outcomes for unemployment - the black line is what actually happened.