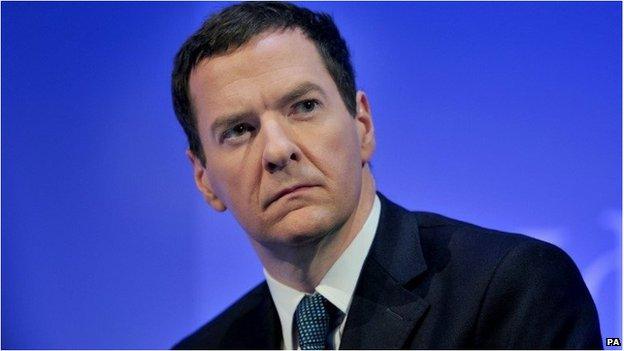

How Osborne would run a budget surplus

- Published

- comments

The chancellor has set out how he would meet his ambition of reducing public sector debt in absolute terms, not just as a percentage of national income, by running a budget surplus in most years.

He would do this by having a new fiscal rule.

That would be that the government would in so-called "normal times" run an overall budget surplus each year.

However, borrowing would be allowed if there were a shock to the economy which required boosting government spending.

It would be allowed to spend more than its tax revenues - to borrow - to avoid a slump, if the Office for Budget responsibility were to rule that times were no longer "normal".

So for example the banking crisis of 2008 - which has led to explosive growth in the national debt to 80% of national income or around 1.5 trillion pounds - would have been classified as a departure from the norm.

But each and every time the government was allowed to borrow, it would have to set out to parliament how and when it would return the public finances to surplus.

George Osborne hopes in this way to allay concerns that his desire to reduce the debt would not risk reinforcing recessions, as and when they bite.

And his rationale for reducing the debt is to protect the public finances from soaring well above 100% of national income, next time there is some kind of economic debacle.

However Labour is likely to accuse him of an ideological commitment to shrinking the public sector, to the detriment of public services.