Will the wealth of the 1% overtake the rest of the world?

- Published

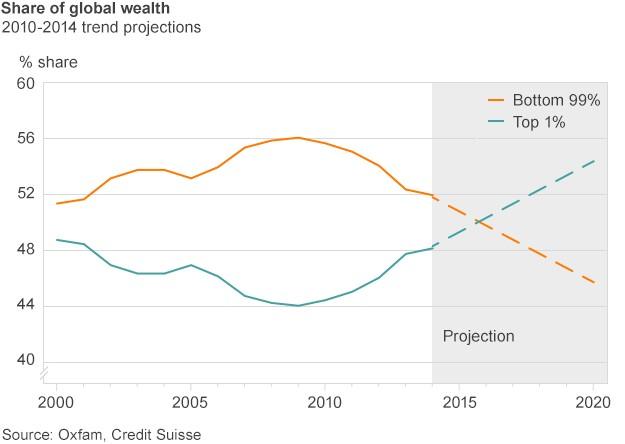

An Oxfam report has predicted that the wealthiest 1% of the world's population will have more wealth than the other 99% at some point next year.

To get to this figure, Oxfam has taken figures from a Credit Suisse report, external, which looked at wealth distribution since 2000.

There are two clear trends over that period. From 2000 until 2009, the proportion of wealth held by the wealthiest 1% fell. From 2010 until 2014 it rose. Oxfam has taken the figures since 2010 and used them to extrapolate what will happen in the coming years.

Clearly, that is the methodology that will make inequality look the most severe. In fact, by 2014 the proportion of wealth held by the top 1% had not quite reached the level it was in 2000.

Paying tax

Is it fair to assume that the trend of the last five years will continue? The collapsing price of oil may be bad news for some of the super-rich.

But to work out what needs to be done if there is to be less inequality, we have to look at why that trend was reversed in 2009, which is a tricky question.

Oxfam's report, external issued on Monday talks about the richest people spending a great deal on lobbying activities and now Oxfam has been talking to BBC News about wealthy people and big companies not paying enough tax.

I have not seen strong evidence that that explains the big turnaround in 2009 and 2010. A trend since then that may be responsible is the growth in the value of financial assets, as a result of policies such as quantitative easing, that governments have been using to help their economies recover from the financial crisis.

Oxfam provides a list of the world's billionaires, broken down by which sector they work in. Top of the list with 326 billionaires is finance, well ahead of real estate with 160, so the super-rich would be just the people to benefit from financial assets rising in value.

Of course, when Oxfam refers to the top 1% wealthiest people in the world, they are not just talking about the super-rich, they are talking about 70 million people.

You don't need a yacht or a ski chalet to join that group. You'd need assets, including property, worth $798,000 (£526,000), which would only just buy the average house in London. If you own a home in London and do not have much mortgage left to pay on it, then you may be part of the 1%.

'Poor data'

The report from Credit Suisse on which all this is based was an ambitious piece of work, but also carried caveats.

Not all countries collect data that would allow researchers to analyse the distribution of wealth, and there are judgements that need to be made about the definitions used.

For example, the people with the lowest wealth are not those with nothing, living in sub-Saharan Africa. It is those living in rich countries who are in debt and so count as having negative wealth.

Should those people count as a negative figure in the research, or should they count as zero wealth?

But the report's authors are confident that while the data "remains poor for many countries", the broad trends are still reliable.

For Oxfam, a few percentage points here or there are probably not relevant in the assessment of whether inequality is unacceptably high, but insights into why the trend of inequality reversed in 2009 and 2010 would help with policy proposals.

- Published19 January 2015

- Published19 March 2014