Savings rates: The pros and cons of striving for returns

- Published

Savings rates have been low for some time

Savers can be forgiven for their frustration.

They carefully set money aside each month, saving loyally with the bank or building society that they have used for life.

In return, many are getting an interest rate that fails to match inflation. They could buy more with the money when they first had it, than after they saved it. The lowest savings rate on the market is just 0.01%.

Such is the plight of the saver in the UK, where the Bank of England base rate has been at a record low of 0.5% for nearly six years.

Experts say it is still worth shopping around for a decent deal, although taking any promise of eye-popping returns from an unregulated provider is fraught with danger.

Loyalty

So, how did it get this way?

The banking industry says that the low interest rate environment means providers have been unable to offer more to their loyal savers.

But the City watchdog has suggested that customers' loyalty has often been misplaced. Savers have not switched from 80% of easy access accounts in the last three years, the Financial Conduct Authority (FCA) says, external.

Those who have stuck with older savings accounts tend to earn less interest than those who have opened a new one more recently.

"The difference between a really poor interest rate and the very best interest rate can sometimes [mean] hundreds, if not thousands, of pounds," says Anna Bowes, director of Savingschampion.co.uk.

"So it is definitely worth looking at the interest rate you are earning and switching to the very best rate you can find."

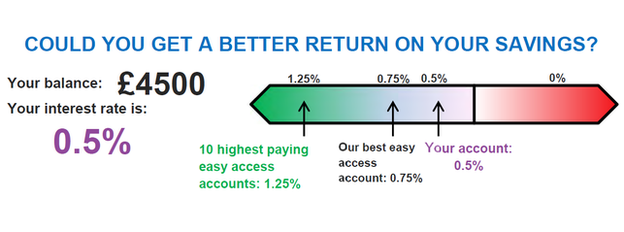

Customers could be sent a "switching box", to show how their savings rates compare

The FCA has just come up with a series of proposals that it says will make this process easier.

Among the suggestions is clear information on an account's paperwork outlining the customer's current rate and comparing this to the best equivalent deals around.

This so-called "switching box" is similar to some of the information provided to domestic energy customers, and Ms Bowes questions why people bother to switch energy providers but fail to switch savings providers for the same financial gain.

Investment risks

The answer might be that some of those who are willing to do the work of shopping around are choosing to put their lump sum at risk by investing the money, rather than leaving it in a savings account.

"We are not expecting interest rates to go up any time soon. For some, risk is a prerequisite," says Martin Bamford, a chartered financial planner at Informed Choice.

That is not necessarily the case for pensioners, who are hoping to reduce financial risk at their stage of life. No doubt, that is why the new Pensioner Bonds from government-backed National Savings and Investments (NS&I) caused so much interest that the website and phone lines were overwhelmed on the first day of sale.

However, for others with a longer-term view on their finances, Mr Bamford says they are willing to take a risk for some reward.

He says that nine out of 10 of his clients have no particular ambition for where their money should be invested, but some may have spotted what they thought was the next big thing.

Anyone who thought that currency was the best option may have experienced a sharp intake of breath as they saw the Swiss National Bank abandoning the franc's peg to the euro.

Some of the particularly questionable investment suggestions made to Mr Bamford, he says, include Brazilian teak forests, Mexican golf courses, and gold dust reclamation.

Protection

Caroline Barr says that savers and investors need to do their homework

Various investment and savings scams lurk on the internet, with promises of high returns.

At least 4,000 people were the victims of an investment fraud last year, says Caroline Barr, of the Financial Services Consumer Panel.

"We know this is under-reported, because many people are too embarrassed to admit that they have been taken advantage of and exploited," she says.

"It is good that people are shopping around, but they must be very diligent and make sure they are giving their money to people who are authorised to deal with it."

Authorisation is given by the FCA, and anyone can check that a provider has matched the requirements by looking on the FCA website, external.

They should also be aware, she says, of the detail of the Financial Services Compensation Scheme, external.

This covers savings of up to £85,000 of savings per person, per institution, if a bank, building society or credit union goes bust. It can cover some investments too, but certainly not all.

Savers should also be aware that various brands might only come under the umbrella of one institution, so if they have spread money around they should check all their deposits are protected should the worst happen, she says.