Pension changes 2015: Annuity or pension drawdown?

- Published

Many more people could soon be blowing their pension pot on a Caribbean cruise

Shall we cruise to the warm sunshine of Antigua - or the midnight sun of Norway? Should it be cobalt blue or viridian green for the new Aston?

From 6 April 2015, such dilemmas could become real for some, as the government gives those over 55 the freedom to spend as much of their pension savings as they like.

In truth, the surveys suggest most people are rather more modest in their dreams - with a decent income in retirement at the top of the list.

For those not in Defined Benefit (DB) schemes, that means using a pension pot to generate an income for the rest of life.

With maybe twenty or thirty years of retirement ahead of some people, that is a huge decision.

And usually that means deciding between buying an annuity, or "income drawdown".

'Flexibility'

"The majority of people don't want to take risks with their money," says Stephen Lowe of Just Retirement.

"People don't want to be kept awake at night, worrying about their pensions."

That's why his company mostly sells annuities.

Annuities provide a fixed income, for the rest of your life. The payments are guaranteed, so once you've bought one, you should certainly sleep soundly.

The alternative is to keep your pension pot intact, and "draw down" income from it, as and when you need it. In some circumstances it can provide a higher pension. But it is also much more risky.

"The benefits are better, because there's a flexibility in terms of the income you take year-on-year," says Jamie Smith-Thompson, managing director of Portal Financial.

The policies sold by his company are mostly drawdown.

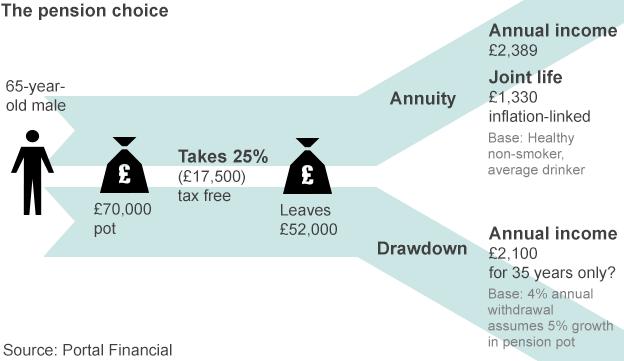

Based on a £70,000 pension pot - and a 25% tax-free withdrawal - a healthy 65 year-old man buying a single, inflation-linked, annuity could expect an annual income of £2,389 on top of his state pension. If he wants his partner to receive the same income after he dies, he might receive around £1,330.

This assumes he also wants to take out his 25% tax-free lump sum of £17,500.

Alternatively, should he decide to draw down a part of his pension every year - leaving the rest of his pot invested in shares, bonds or cash - he could get around £2,100.

This assumes he withdraws 4% of his pot in income every year, and that his investments grow at an annual rate of 5%. But if he lives past 100, he may have to reduce the amount he takes, to maintain the capital in the fund.

The main advantage of such policies is their flexibility, which may work particularly well for people who continue to work part-time.

Should I buy an income drawdown policy?

Until 6 April, the amount you can take from a drawdown account is limited, or capped - unless your pension income already exceeds £12,000 a year.

After that date, everyone will be free to withdraw what they like.

From April too, your descendants will be able to inherit the unused part of your pot more easily.

But the danger is that your savings could dwindle more quickly than you expect - particularly if the stock market crashes.

In other words, you could run out of money, especially if you live longer than you expect.

"There are a lot of risks attached, and you've got to be prepared to invest for the longer term to benefit," admits Jamie Smith-Thompson.

Some advisers suggest only taking the "natural" yield of investments instead, to preserve the capital value of the pot. That probably means taking an income of around 3.5%.

Beware the charges too. You could easily lose 5% of your savings, just to set the scheme up.

Pension Calculators

State pension calculator DWP, external

Combined state, workplace and DC calculator, from Standard Life, external

Should I delay buying an annuity? Hargreaves Lansdown , external

How much can I earn from a DC pot? Money Advice Service, external

Should I buy an annuity?

Some providers have reported a huge drop in sales of annuities, since the government announced the new pension freedoms in 2014.

In fact buying an annuity by the age of 75 has not been compulsory since April 2011.

With annuity rates low, many schemes offered poor value, especially when people retiring failed to shop around with other providers.

Yet an annuity may still be the best product if you want a secure income for the rest of your life. And it will almost certainly be the best product if you are ill, or have shortened life expectancy, which enables you to buy an "enhanced" product.

A heavy smoker buying an enhanced annuity could easily see their annual pension increase by a third. Heavy drinkers, or those with high blood pressure, will get a higher income still.

But the following options will reduce the size of the pay-out:

If you want the pension to pay out for a guaranteed period, say five or ten years, if you die early (guarantee)

If you want your partner to receive an income after your death (joint life)

If you want your income to rise with inflation (inflation-linked)

Stephen Lowe believes that 75% of retirees want the security of an annuity.

"People say, I need something to pay my bills. I don't want to run out of money."

But looked at another way, buying an ordinary annuity is a risk in itself - if you or your partner die early, you won't get your money back.

And if inflation is lower than expected, you might have overpaid for an annuity which rises with the cost of living.

Can I buy both?

The chancellor, George Osborne, has now promised more flexibility with annuities, allowing people to sell them after April 2016.

Even so, it is hard to see how anyone selling an annuity will be able to find good value if they do so.

Free guidance on pensions is available from the government, at Pension Wise

One sensible thing to do for many people will be to buy a drawdown product to start with, and then switch to an annuity later.

This might work particularly well if someone continues to work part-time until the age of 70, say.

In any case, following the April 2015 changes, many pension providers are expected to release products which are a mixture of annuities and drawdown.

Some providers already offer drawdown policies which guarantee a certain level of payment.

"Annuities are going to change massively after April," says David Smith of TilneyBestInvest.

"They will almost be a hybrid - and will be targeted at smaller pots."

In any case, the decision will need proper, unhurried, thought, perhaps with guidance from the government's free service, external.

Perhaps best undertaken before you contemplate that sunset, from the deck of a cruise ship.