Greece: Greenspan predicts exit from euro inevitable

- Published

Greenspan says only political integration will save the euro

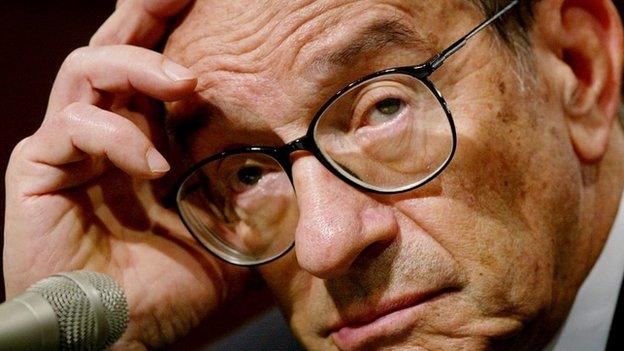

The former head of the US central bank, Alan Greenspan, has predicted that Greece will have to leave the eurozone.

He told the BBC he could not see who would be willing to put up more loans to bolster Greece's struggling economy.

Greece wants to re-negotiate its bailout, but Mr Greenspan said "I don't think it will be resolved without Greece leaving the eurozone".

Earlier, UK Chancellor George Osborne said a Greek exit would cause "deep ructions" for Britain.

Mr Greenspan, chairman of the Federal Reserve from 1987 to 2006, said: "I believe [Greece] will eventually leave. I don't think it helps them or the rest of the eurozone - it is just a matter of time before everyone recognises that parting is the best strategy.

There is "no advantage" in lending to Greece according to Alan Greenspan

"The problem is that there there is no way that I can conceive of the euro of continuing, unless and until all of the members of eurozone become politically integrated - actually even just fiscally integrated won't do it."

Following the election in Greece of the anti-austerity Syriza party, Greek ministers have been touring European capitals trying to drum up support for a re-negotiation of its bailout terms.

Euro break-up

However, there appears little willingness in Berlin, or at the European Central Bank, to alter the terms of its €240bn (£182bn) rescue by the European Union, ECB, and International Monetary Fund.

Greece's prime minster Alexis Tsipras (seated) and his finance minister Yanis Varoufakis have been on a whistlestop tour of European capitals.

"The [bailout] conditions with Greece were generous, beyond all measure,'' German Finance Minister Wolfgang Schaeuble said last week. He saw no justification for relaxing them further.

Mr Greenspan said: "All the cards are being held by members of the eurozone."

He also warned that trying to hold the 19-nation euro bloc together "is putting strain on everybody". He said as well as Greece leaving the eurozone, there was a real risk of a "much bigger break-up" with other southern European countries forced out.

Analysis: Joe Lynam, business correspondent

Alan Greenspan has long been a critic of the European single currency. Now, the 88-year-old former chairman of the US Federal Reserve has repeated a claim that nothing short of full political union - a United States of Europe - can save the euro from extinction.

Given that few (if any) of the current 19 sovereign governments which make up the eurozone would choose to create such an entity at this time, that means - for Greenspan at least - the euro is doomed.

Before all that, though, he foresees Greece quitting the single currency, but the euro surviving intact. Grexit, he says, is more manageable now than it would have been when Greece got its first EU bailout in 2010.

But Greenspan has been badly wrong before. He said markets (and banks in particular) would always act rationally and prevent self destructive crashes. Then the financial crisis happened in 2008 - plunging the world into a massive recession. He did, though, admit his error.

Earlier on Sunday, Mr Osborne told the BBC's Andrew Marr Show that the UK was stepping up contingency planning to prepare for a possible Greek exit.

"This stand-off between Greece and the eurozone is increasing the risks every day to the British economy," the chancellor said.

A Greek exit from the single currency would create instability in European financial markets and cause "real ructions" in Britain, too, he added.

Greece's prime minister Alexis Tsipras wants to put in place a short-term financial plan enabling the country to pay its way while it renegotiates the austerity cuts and conditions attached to its bailout terms. The existing bailout ends on 28 February.

Mr Tsipras made his first major speech to parliament since taking over as prime minister on Sunday evening.

He said he would stick to his campaign pledges, which include giving free food and electricity to the poor. He promised to cut politicians' benefits, such as ministerial cars and said he would fight against corruption and tax avoidance.

He also said he would seek a loan, not an extension to the bailout.

Mr Tsipras is to meet EU leaders at a summit in Brussels on Thursday. Mr Varoufakis will meet eurozone finance ministers the day before.