When is it OK to have a Swiss bank account?

- Published

More than one hundred banks have offices in Zurich, Switzerland

Plenty of celebrities - and rich Brits - have Swiss bank accounts. Believe it or not, some are even residents of Switzerland.

But if you are a full UK taxpayer with a Swiss bank account, you have to declare any income from it to HM Revenue and Customs (HMRC).

If you fail to do so, you are guilty of tax evasion, which is an offence.

The same goes for any income you make anywhere in the world, even if that money is not repatriated to the UK.

The only exception to that is if you are not domiciled in the UK, so you are a "non-dom".

Thus an American banker who comes to work in the UK for a period of say, five years, might be a UK resident, but also a non-dom.

He or she would not have to declare international income to HMRC.

However, since 2008, non-doms are only entitled to be free of UK income tax on foreign earnings for seven years - unless they pay HMRC a sum of £30,000.

Secret accounts

Tax relations between the UK and Switzerland were changed by an agreement that came into force on January 1 2013.

Under the deal, Swiss banks were obliged to declare account details to HMRC.

British account holders with long-standing accounts could agree to pay a one-off levy to HMRC of up to 41% of their income.

Or, if they wanted their account details to remain secret, they could allow the Swiss authorities to levy a tax themselves.

However, that would not necessarily make them immune to prosecution by HMRC.

The agreement also allowed the UK to request the bank details of up to 500 individuals a year.

The deal was supposed to raise £3bn in tax receipts for the UK in its first year. In the event, it only raised around £1bn.

Tax Gap

Thereafter, the legality of a Swiss bank account will depend on whether it amounts to tax avoidance or tax evasion.

Tax evasion - the deliberate attempt to deprive the UK government of tax - can result in a prison sentence, or a fine twice as large as the amount owed.

While there is still nothing illegal about tax avoidance, it has recently become much more of a grey area, as the government has sought to clamp down on a range of schemes.

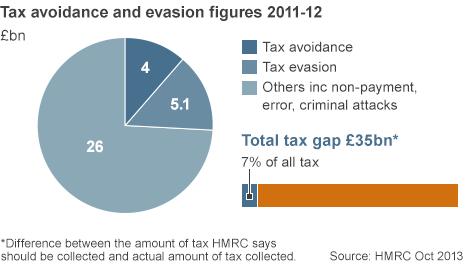

Tax avoidance currently costs the taxpayer £4bn a year, according to the latest figures from HMRC.

That is very nearly as much as illegal tax evasion, which costs £5.1bn.

Together, they account for about a quarter of the £35bn that is lost to the Treasury every year, otherwise known as the "tax gap".

Rules

MPs recently criticised companies like PricewaterhouseCoopers, which help their clients avoid tax.

HMRC defines such schemes that involve "contrived, artificial transactions that serve little or no purpose other than to produce a tax advantage."

"They involve operating within the letter - but not the spirit - of the law," it says.

If you do get involved in aggressive tax avoidance schemes, you may end up in a protracted dispute with HMRC, and if you lose, you risk having to pay the tax, the interest and penalties as well.

In some cases, avoidance can quickly turn into evasion.

If you conceal facts, or lie about them, you can be judged to be breaking the law.

To help taxpayers, HMRC advises UK residents to look out for the following signs of avoidance schemes which it is likely to challenge:

it sounds too good to be true and cannot have been intended when Parliament made the relevant tax law (for example, some schemes promise to get rid of your tax liability for little or no real cost, and without you having to do much more than pay the promoter and sign some papers)

the tax benefits or returns are out of proportion to any real economic activity, expense or investment risk

the scheme involves arrangements which seem very complex, given what you want to do

the scheme involves artificial or contrived arrangements

the scheme involves money going around in a circle, back to where it started

a tax haven or banking secrecy country is involved

the scheme contains exit arrangements designed to side-step tax consequences

there are secrecy or confidentiality agreements

upfront fees are payable or the arrangement is on a "no win, no fee" basis

the scheme has been allocated a Scheme Reference Number (SRN) by HMRC under the Disclosure of Tax Avoidance Schemes (DOTAS) regime.