The deflation that isn't deflation

- Published

- comments

The Bank of England expects inflation to be zero or very close to zero for most of this year, starting in March.

And it says there is a greater than evens chance that it will turn negative, that prices will fall, for much of this period.

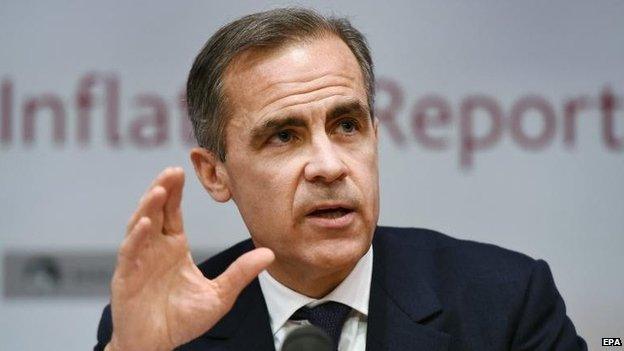

But the governor, Mark Carney, insists in his letter to the chancellor that this is not deflation.

This is what he says: "The UK is not experiencing 'deflation': excluding food and energy, 68% of the underlying categories of the CPI are showing positive inflation, close to the 1997-2007 average of 67%".

But it is quite a big thing to exclude oil, energy and food - where price falls have been significant and sustained. And those falls are in part linked to the weakness of the global economy.

The Bank also acknowledges that price pressures in general are feeble, especially from lacklustre wage increases.

But Mr Carney insists this should not be seen as "generalised and persistent declines in prices" of the sort that could be characterised (in his vocabulary) as "deflation".

Clear?

In fact, the Bank's current projection is that inflation will rise to the target rate of 2% by the middle of 2017, without it having to take any evasive action.

If it is right, the Bank would be increasing interest rates - by a tiny amount mind you - some time next year.

Two other important things - which will certainly put a spring in the step of the chancellor so close to the election.

First is that for this year - and thanks largely to the impact on spending power of lower oil, energy and food prices - the Bank is forecasting a rise in real (inflation-adjusted) post-tax household income of 3.5%, the biggest rise in take-home pay for a decade.

Second, the Bank of England expects the stimulus from this improved household prosperity to generate growth next year of 2.9%, the same as this year's projection, and a bit better than it predicted only three months ago.