South African budget raises taxes and cuts spending

- Published

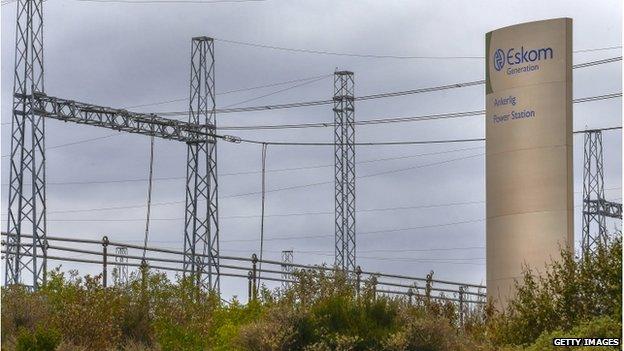

Problems at Eskom - South Africa's state-owned energy provider - could hold back economic growth

South Africans were told on Wednesday to prepare for higher taxes, cutbacks in spending and three more years of power cuts.

The government's annual budget outlined a 1% increase in personal income tax and spending cuts of 25bn rand (£1.4bn; $2.2bn) over the next two years

Projected economic growth for 2015 is 2%, down from 2.5% forecast last year.

Finance Minister Nhlanhla Nene warned the economy would suffer from another three years of power disruptions.

Economic growth could even halve again down to just 1% this year if power constraints worsened.

He said state-owned power group Eskom faced a 200bn rand funding gap up to 2017.

Eskom will receive a capital injection of 23bn rand this year, to be raised through the sale of non-strategic government shareholdings in some state-owned companies.

Electricity prices will rise to finance Eskom's rebuilding of the country's power infrastructure.

Mr Nene said he would also introduce a temporary increase in the electricity levy, to 5.5 cents per kilowatt hour (kWh) from 3.5 cents/kWh.

"The most important challenges facing the economy are unemployment and the security and reliability of the energy supply," he said.

"Today's budget is constrained by the need to consolidate our public finances, in the context of slower growth and rising debt."

Strikes at the platinum mines last year have hampered the economy

Debt

Economic growth in 2014 was 1.5%, dragged down by prolonged labour strikes in the key mining sector as well as energy shortages.

Mr Nene called for moderation in wage increases to spur faster growth and create more jobs. The unemployment rate stands close to 25%.

Public sector union Nehawu is in talks relating to demands for pay increases way above inflation. The Treasury forecasts inflation will be 4.3% in 2015, and rise to 5.6% in 2016.

The budget also included spending cuts of 25bn rand over the next two years, while maintaining core social and economic programmes.

Matthew Davies, editor, Africa Business Report, writes:

Some analysts have called his plans a "Robin Hood" budget, because of the tax increases for the rich, in a country were welfare recipients outnumber tax payers. But Mr Nene admitted himself he had little scope for what he described as a "challenging" budget to prepare. South Africa's economy has been having a hard time. Last year, industrial action, including a prolonged strike on the country's platinum mines, severely reduced growth. This year, rolling blackouts (better known as load-shedding here) are pushing some small businesses to the brink of bankruptcy. But there was nothing in the budget speech that was new - Mr Nene is not a big one for surprises. What everyone will be watching now is the next few months. Wage negotiations on the country's gold mines are due by the middle of the year, with the accompanying threat of strikes. Meanwhile, unemployment, particularly among young people, remains stubbornly high, despite efforts to reduce it. However, the real test will be how fast the power situation can be solved. Some analysts say while the lights stay on, there's hope. Once they go out, it spells dark times ahead.

South Africa's deficit has risen to 3.9% of the economy this year rather than the 3.6% forecast.

The ratings agency Moody's has downgraded South Africa's sovereign debt rating in November, following similar downgrades from rival agencies Fitch and Standard & Poor's.

Moody's said its decision was based on "poor medium-term growth prospects due to structural weaknesses, including ongoing energy shortages as well as rising interest rates".

Net debt has doubled since the start of the financial crisis as the country increased borrowing to try to repair the economy. Mr Nene said debt was expected to stabilise at less than 45% of GDP in three years' time.

- Published7 November 2014

- Published5 November 2014

- Published6 May 2014