HSBC bosses apologise for 'unacceptable' practices

- Published

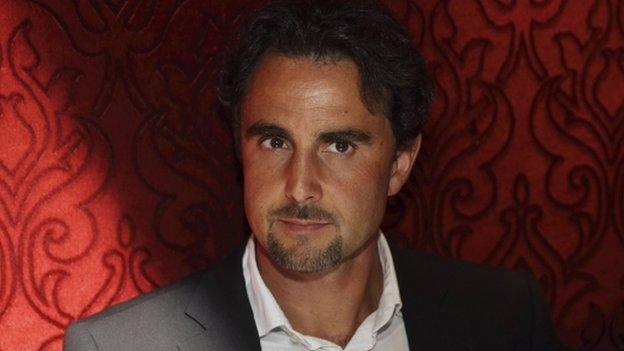

HSBC chief executive Stuart Gulliver: "I would like to put on the record an apology"

The two top HSBC bosses have apologised for "unacceptable" practices at its Swiss private bank which helped clients to avoid tax.

Stuart Gulliver, group chief executive, said it had caused "damage to trust and confidence" in the company.

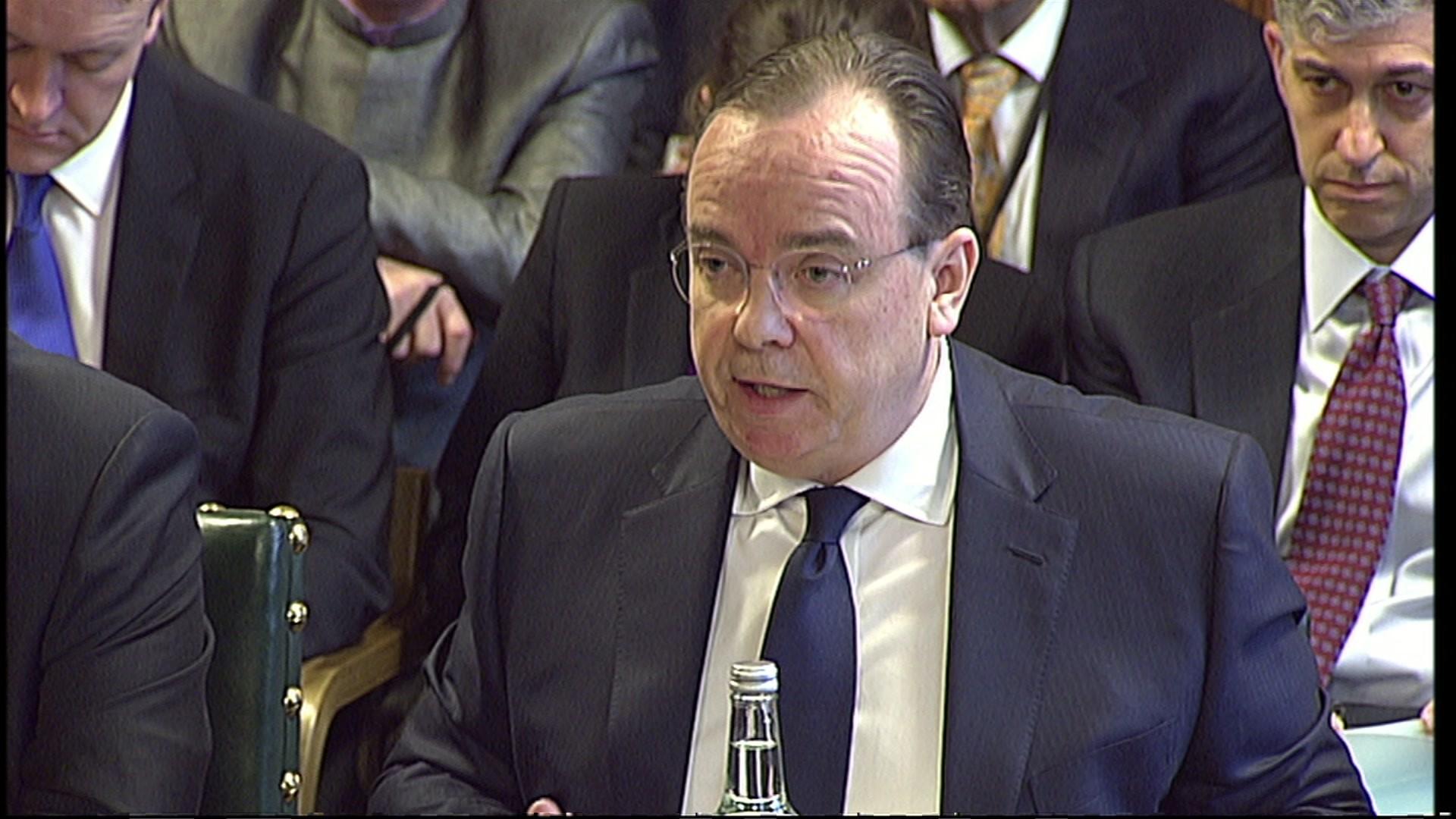

He and chairman Douglas Flint were answering questions from UK Members of Parliament of the Treasury Committee.

Mr Flint said he felt shame and would "take his share of responsibility" for Swiss private bank failings.

But when asked by MPs who was most responsible for the problems in HSBC's Swiss private bank, Mr Flint said: "The individuals most accountable for the data theft and the behaviour that was unacceptable to our standards, was the management in Switzerland.

"Most culpable were the relationship managers [in the Swiss private bank]."

Mr Flint estimated that some 30% of those relationship managers were still employed by HSBC.

Leak

Information about some 30,000 accounts at the Swiss private bank operation were leaked in 2007 to French tax authorities who passed it on to the UK tax authorities (HMRC).

Former director of public prosecutions Lord Ken Macdonald QC said last week that there was sufficient evidence for the bank to be investigated for conspiracy to defraud the UK tax authorities.

However, Jennie Granger, director general enforcement and compliance at HMRC told the Treasury committee: "What we had was intelligence, not evidence. It was stolen data, it's quality was not good.... and we were dealing with a jurisdiction that would not accept stolen data as evidence."

Lin Horner, chief executive of HMRC, said that earlier this week the French authorities had approved wider use of the stolen Swiss data.

Fines and probes

HSBC has been involved in a range of banking scandals, including foreign exchange manipulation and rigging of international interest rate benchmarks.

When asked about the wider list of allegations and investigations into HSBC by international regulatory authorities Mr Flint said: "it's a terrible list."

Despite reforms, he said he could not exclude the possibility of further problems emerging.

He said the task of reforming HSBC will "always be ongoing".

The Committee's chairman, Andrew Tyrie, asked him what the prospects were of "another rotten bit of HSBC popping out of the woodwork".

Mr Flint replied: "In relation to not having line of sight to what's happening at lower levels in the organisation, I think the control environment because of the progressive implementation of a single set of standards is very much stronger than it was in the past."

"No tax purpose"

Mr Gulliver, who has worked for HSBC for 35 years and became chief executive in 2011, told the committee that his personal holding of a Swiss bank account through a Panamanian company had "no tax purpose".

He said the arrangement only reflected a desire for privacy from his colleagues at HSBC in Hong Kong.

He said: "It was purely about privacy from colleagues in Hong Kong and Switzerland. We had a computer system back in the day that allowed everybody to inquire into staff accounts ... I was amongst the highest paid people and I wished to preserve my privacy from colleagues. Nothing more than that."

Mr Gulliver told the committee he had "followed the letter of the law" of the UK non-domicile rules,

He said: "The important point is I've paid UK tax on my HSBC earnings during that entire period [since being based in the UK], so the amount of tax I have paid is the fair and appropriate amount."

- Published25 February 2015

- Published25 February 2015

- Published25 February 2015

- Published23 February 2015

- Published23 February 2015

- Published23 February 2015

- Published17 November 2014

- Published9 February 2015