UK house prices fell 0.1% in February, says Nationwide

- Published

House price inflation has slowed in the UK

UK house prices fell in February for the first time in five months, according to research by Nationwide.

Average house prices fell 0.1% from £188,446 in January to £187,964, said the UK's second biggest mortgage lender.

Annual house price growth slowed for the sixth month in a row to 5.7%, its lowest since September 2013.

House prices have fallen in spite of the UK's improving economic outlook and access to low interest rates.

"Mortgage rates remain close to all-time lows and consumer confidence remains buoyant thanks to a further steady improvement in labour market conditions," said Nationwide's chief economist Robert Gardner.

Figures from the Bank of England, also published on Monday, showed that the number of mortgages approved for house purchases crept up in January.

There were 60,786 home loans approved. Despite the rise from 60,349 approvals in December, the total remained below the average of the previous six months.

First-time buyers

The long-term decline in the number of young and first-time buyers may be helping to cool the market, which made significant gains in 2013 and early-2014, the Nationwide said.

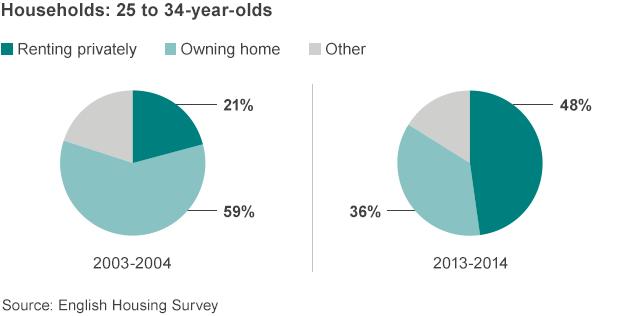

Among 25 to 34-year-olds, the proportion of households owning their own home in England fell from 59% in 2004 to 36% in 2014.

In contrast, among all age groups, those owning their home outright, without a mortgage, overtook those making mortgage payments in England for the first time in 2013-14.

The government is offering a discount of up to 20% for first-time buyers under the age of 40 under its planned new "starter homes" scheme.

Most political parties are proposing a housebuilding programme should they win power in the election.

There is a wide range of house prices across the country. Average property prices in London were £458,283 in London compared with £97,974 in the North East of England in January, according to data published on Friday by the Land Registry, external.

Analysts argue that a long-term view is needed on the housing market.

Stephen Smith, director of the Legal & General Mortgage Club, said: "Over the past couple of years, prices have risen rapidly and are close to exceeding their 2007 peak.

"While this may be viewed as a positive indicator of confidence in the market, it is important not to price people out. To avoid this, and allow the market to grow in a sustainable way over the long-term, we need to build more houses."

Rob Weaver, director of investments at the property crowdfunding platform Property Partner, said: "The market is taking a breather and is certainly not on the brink of a longer term decline.

"A return to steady growth is a good thing and should be welcomed."

The interactive content on this page requires JavaScript