Aston Martin battles to reinvent itself

- Published

Aston Martin was without a chief executive for 18 months before Andy Palmer took up the post

Andy Palmer called it the most important speech of his career. Barely six months into his job as chief executive of Aston Martin, he has unveiled a new strategy for the company at the Geneva Motor Show.

Aston Martin may be one of the most famous brands in motoring, but it's been loss-making for decades and has seen sales tumble.

Without a change of direction, the British sports car maker was facing a slow and ignominious demise.

"I don't think the brand would ever disappear. There will always be people who want an Aston as a trophy asset," Mr Palmer said. "But the company itself was looking at long-term distress."

In its 102-year history Aston Martin has only sold 70,000 cars. It's a figure that surprises people, and is testament to the company punching above its weight.

But the ultra-premium car market is becoming crowded. Rivals with deeper pockets - Bentley, Ferrari, Porsche - have new products, and some of the big carmakers are moving outside their traditional core saloon market.

"Aston Martin has always relied on someone stepping in and injecting some more cash and saving it. But that's not the legacy I want to leave," Mr Palmer said.

A new strategy was needed for a new era.

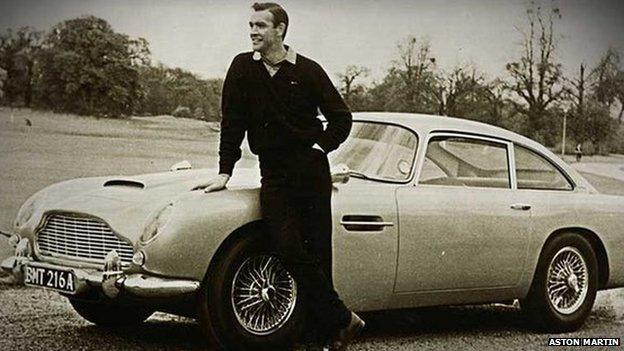

Aston Martins have always been the vehicle of choice for James Bond, from Sean Connery...

...to the current 007, Daniel Craig

Female customers

Aston Martin had been without a chief executive for 18 months before Mr Palmer took up the post last year.

He was recruited from Nissan by the company's major shareholders, Italian private equity firm Investindustrial and Kuwait's Investment Dar and Adeem Investment.

As Mr Palmer had been part of a Nissan team that looked into buying Aston Martin three years ago, he arrived at its Warwickshire headquarters knowing what was needed.

His new plan - backed by more than £500m of fresh money - involves broadening Aston Martin's range of cars to appeal to a younger and female customer.

There will be new models and a refresh of existing ones. The company is making its first Lagonda model in 30 years. And there will be Aston Martin's first all-electric, four-wheel drive car, the DBX.

Key to the strategy is to target "Charlotte". She's a rich American female in her late 30s. "She's a cool lady, she's an attractive lady," Mr Palmer said.

The company is changing the interior of its cars to target a broader range of customers

She's also fictitious, an idealised vision of the sort of new car buyer Aston Martin wants to attract.

"When you start on a new car, you start with your customer in mind," he said. It affects the design of the interior and the ergonomics. "The DBX has been designed for a young lady, sophisticated and rich," Mr Palmer said.

He estimates that Aston Martin has sold about 3,500 cars to women in its long history. In the modern world, that needs to change. No longer can Aston Martin rely on the middle-aged enthusiast who has been the mainstay of past sales.

"Aston Martin must be less dependent on a narrow portfolio and one type of customer," Mr Palmer said.

Aston Martin plans to make just 24 of its new Vulcan model

Vulcan

He's keen to stress that broadening the range does not mean eroding the brand. Aston Martin's annual sales have fallen to about 4,000 from 7,300 in under decade.

To retain exclusivity, he wants to cap sales of the sportscar models at 7,000 units, while pushing all models into so-far under-served markets such as the Far East.

But there will be no retreat from building niche products.

Geneva saw the launch of Aston Martin's Vulcan, representing the "best of everything we know and can do," Mr Palmer said. It's a £1.8m track-only supercar unlike anything the company has produced before.

Just 24 are being made (the number being a nod to Aston Martin's history in 24-hour endurance racing), and with demand outstripping supply Mr Palmer is not worried about selling them.

But could the loss-making company have better spent the money? "We needed a car that would keep us relevant in the eyes of our customers. The fact that we are here talking about it means that we have succeeded," Mr Palmer said.

"We have to create a design language for the future cars. The Vulcan's design, the engineering, the language, will be taken forward to the new range of production cars."

The firm now has 14 dealers in China

'Bloody nose'

Only 2,500 Aston Martins have ever been sold to customers in the Bric nations of Brazil, Russia, India and China.

On paper, then, it looks like the company has a huge market to aim for, and Mr Palmer was quick to reorganise management in preparation.

Managerial layers have been stripped out. Previously, the firm had a sales department but no marketing department.

"We needed to be more customer-focused, and have some regional muscle," he said. The company now has 14 dealers in China, and has just opened in Thailand.

Aston Martin is not disclosing sales forecasts, but Mr Palmer says he wants to "create a company with decent scale" to compete with the competition.

The firm also unveiled its new Vantage GT3 in Geneva

It helps that a minority shareholder is Daimler, which owns 5%. The German company has not provided money for the current model revamp, but it does share technology.

"Daimler gives me a lot of access to the technology that the bigger groups have. It's technology that we could not afford by ourselves," Mr Palmer said.

The benefits for Aston Martin are clear, but what's in it for Daimler - apart from hoping its 5% stake will rise in value?

"If you were sitting in the Daimler boardroom and thinking of giving BMW or Volkswagen a bloody nose, one way to do it is by facilitating us and letting us loose on those guys.

"I think their view is that because we are independent, nimble, we can fight with the likes of Bentley, Lamborghini and the premium carmakers. If they owned us then you'd have all of the company processes put on top," Mr Palmer said.

Reviving Aston Martin's fortunes will be a tough task - and he knows it.

But after decades of the firm living off its reputation, all the pieces needed for a new start are there, he says. The job now is to put those pieces together.