Pension changes 2015: Could you run out of money before you die?

- Published

Some people could be left penniless if they take too much from their pension pots

Even though the chancellor has now promised flexibility to anyone who has bought an annuity, many people will still be reluctant to buy one.

For starters, no one yet knows how easy it will be to sell them back to the market.

So under the changes coming in on 6th April, many retirees are likely to opt for the alternative, known as pension drawdown.

This means keeping your pension pot invested, and drawing an income from it, as and when you need it.

But if you take this route, you will be taking two big gambles.

First, how long do you think you will live?

And second, how much income can you afford to take from your pot?

Get either of those wrong, and you could easily run out of money before you die.

Withdrawal

In answer to the first question, life expectancy once you've reached the age of 65 is currently 83 for men in England and Wales, and 86 for women.

But the danger - in pension terms - is that they may well live very much longer.

That is why deciding on the second issue - the rate at which you can afford to deplete your pension pot - is so important.

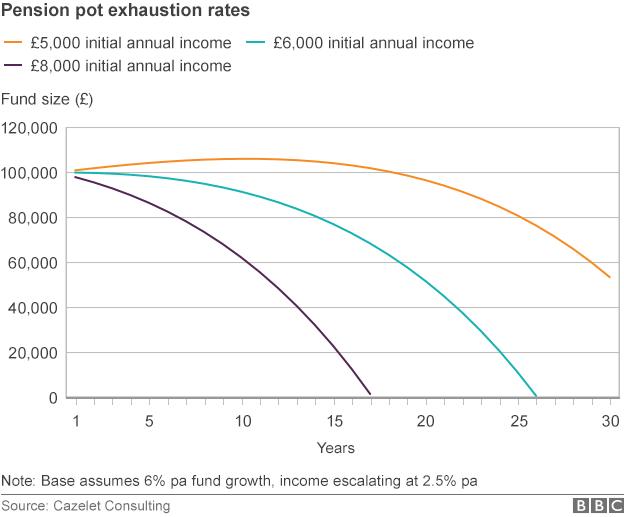

The chart below shows how quickly you can use up your money.

Someone with a pension pot of £100,000 who withdraws at 6% a year - ie £6,000 - will in theory run out of money in 26 years.

Someone who withdraws 5% a year could expect their fund to last much longer: 35 years.

And this calculation assumes the remaining pot grows at 6% a year.

Should it only grow at 4%, the person taking £6,000 a year will run out of money in just 19 years.

Stock market

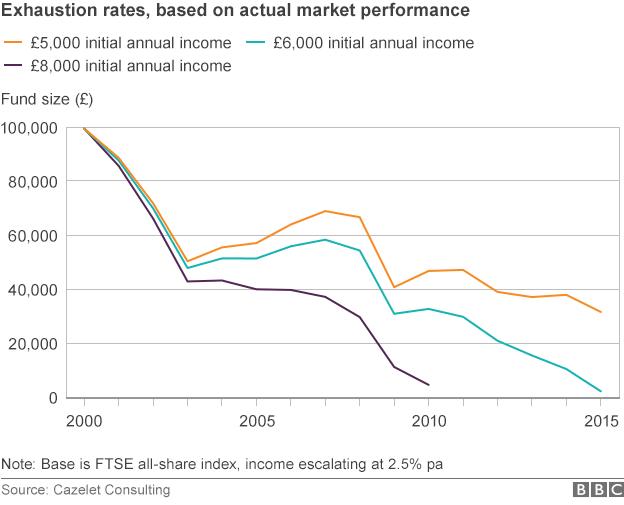

The trouble with the chart above is that it only shows the theory of what should happen to your pension pot.

Indeed Ned Cazelet, the consultant who produced it, calls it a "fantasy".

For according to how the stock market performs in reality, all those theoretical calculations could go, well, to pot.

So the chart below shows what would actually have happened to an investment pot of £100,000, had it been invested in 2000.

In 2001 and 2002 markets fell, wiping away nearly half the value of the savings.

Although share values later recovered, that early damage was a killer blow - resulting in rapid erosion of the capital.

In 2007 and 2008 the same thing happened again.

"Lots of people lost money very quickly," says Mr Cazelet.

"If you do have these slips, you can find yourself going down the hill, and the brakes have failed. You'll never get back up there."

Thus anyone withdrawing £6,000 a year from their pension fund would have run out of money this year - just 15 years after starting it. By withdrawing £5,000 a year, they would at least still have £31,000 left in their fund. But even that might only ensure a further six years of payments.

Natural yield

So how much should you withdraw from a pension fund to make sure it lasts for as long as you want it to?

Some experts talk about a notional "4% rule".

"Taking around 4% per annum is relatively safe, and gives you a good chance of not using up your capital," says Richard Parkin, the head of retirement at Fidelity Worldwide Investment.

Pension Calculators

State pension calculator DWP, external

Combined state, workplace and DC calculator, from Standard Life, external

Should I delay buying an annuity? Hargreaves Lansdown , external

How much can I earn from a DC pot? Money Advice Service, external

But others think even this could be too high, especially if markets perform badly.

So the alternative is to take only the natural yield from investments.

In other words, to take the annual dividend pay-outs in the case of shares, or the coupons in the case of bonds, but to leave the rest of the capital untouched.

This approach is advocated by Tom McPhail, of Hargreaves Lansdown, who believes natural yield is a good starting point.

"If you start drawing on an income pot at the age of 60, you might still be alive at the age of 90," he says.

"Any run-down of capital over that time span could potentially get you in to trouble."

With careful investing, a natural yield should allow an income of 3% or 3.5%.

Free "guidance" is available from the government

Spend it

In an era of low interest rates, annuities may well be out of fashion. But most experts are advising their clients to be extremely careful about relying on income drawdown products.

Mr Cazelet's study, "When I'm 64", shows how poor market performance in the early years of retirement can be particularly damaging.

"I'm not saying that drawdown arrangements are bad, but the client and his advisers need to understand what the risks are," he says.

Mr Parkin suggests that people in retirement need to have some form of regular income first - such as a defined benefit company pension or an annuity - before considering a drawdown pension.

"You should have some guaranteed income to cover your living expenses," he says.

"People need to know that they can sleep at night, and to know they're always going to have somewhere to live and something to eat."

Equally well, he also sees an opposite problem: people being so frightened of running out of money later on, that they do not spend enough of it.

"If people are worried about losing their money, they could end up not touching it at all, and not enjoying the retirement they want to have," he says.