Budget 2015: Chancellor reduces surplus target

- Published

Chancellor George Osborne has reduced the amount of Budget surplus he is aiming for by the end of the next parliament.

Three months ago, the Office for Budget Responsibility (OBR) was predicting a £23bn surplus for 2019-20. It is now expecting a £7bn surplus.

There were small falls in the level of borrowing expected before then.

Mr Osborne also announced that debt as a proportion of national income would fall in the next financial year.

The total government debt as a proportion of the total amount produced by the economy (GDP) is expected to be 80.4% in the year to the start of April 2015, which the OBR predicts will fall to 80.2% in the following 12 months.

The OBR attributed that to "significant asset sales over the coming year", which it said had allowed it to forecast a fall in debt as a share of GDP a year earlier than it had expected three months ago.

The planned sales include more shares in Lloyds Banking Group and some of the mortgage debt it had ended up owning from Northern Rock and Bradford and Bingley.

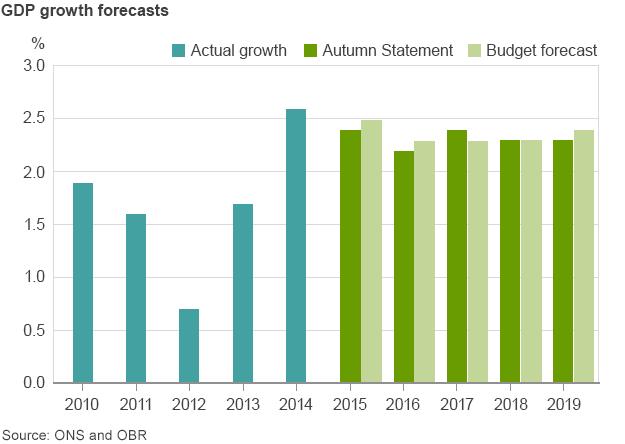

There have also been small increases in the OBR's forecasts for GDP. It has increased its prediction for this year from 2.4% to 2.5%, while 2016 goes up from 2.2% to 2.3%.

The increases came despite the dangers that Mr Osborne outlined of lower global growth and trade and, in particular, the risks that the problems in Greece pose to the eurozone.

The reduction in the expected surplus for 2019-20 reflects the chancellor's decision to end austerity a year early.

"Because the national debt share is falling a year earlier than forecast at the Autumn Statement, the squeeze on public spending ends a year earlier too," he said.

"In the final year of this decade, 2019-20, public spending will grow in line with the growth of the economy."

The OBR said that spending on public services in the next five years under these plans would follow "a rollercoaster profile... a much sharper squeeze on real spending in 2016-17 and 2017-18 than anything seen over the past five years, followed by the biggest increase in real spending for a decade in 2019-20."

Users of the BBC News app tap here, external for the Budget Calculator.

There had been much speculation that Mr Osborne might reduce the amount of surplus being targeted in 2019-20.

There was discussion after the Autumn Statement in December from organisations including the OBR as to whether the spending cuts implied by the £23bn surplus would be achievable.

'Big differences'

The £16bn cut in the targeted surplus closes the gap between the amount of cuts that the Conservatives need to find compared with the Labour Party, which excludes investment spending from its deficit figures.

The Budget documents show that the reduction in the predicted surplus will allow an extra £29.6bn in spending by government departments in 2019-20.

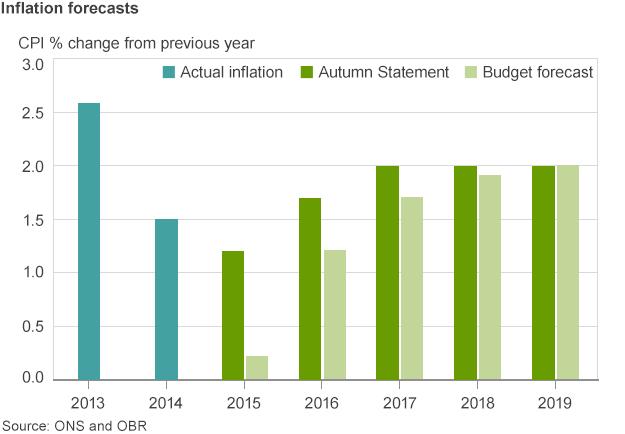

The other big change since the Autumn Statement has been the falling price of oil, which has considerably reduced inflation. The OBR's forecast for 2015 has been cut from 1.2% to 0.2%, while the figure for 2016 has been reduced from 1.7% to 1.2%.

But it is important not to overstate the impact of the Budget measures. The OBR said: "The coalition government's policy decisions in this Budget are not expected to have a material impact on the economy."

Speaking after the Budget, the chief secretary to the Treasury, Danny Alexander, stressed that there were big differences between what had been announced in the Budget and what the Liberal Democrats would do if elected.

The plans laid out in the Budget will probably only be carried out in full if the next government is another coalition between the Conservatives and Liberal Democrats.