Can Osborne get off the rollercoaster?

- Published

- comments

The Chancellor told Jim Naughtie on the Today Prog that the scale of austerity in the opening years of the next parliament would be broadly the same as in the current parliament - and that, by implication, the Office for Budget Responsibility (which he created) was wrong to warn of a "rollercoaster' of public-service spending after the election.

So why are George Osborne and the OBR apparently disagreeing on something so important to all our lives - namely over whether the OBR's projection that between 2016 and 2018 public service cuts will be more than twice as deep as anything we've experienced since 2010?

Well it is because the OBR refuses to take account of £17bn of cuts and savings that the Chancellor says he would make outside of public services such as the police, the courts and the military.

He says there would be £5bn raised from cracking down on tax avoidance, evasion and aggressive tax planning.

And he also says he would raise "12bn from welfare savings".

So why is the OBR ignoring this £17bn?

There are a number of reasons.

The first is that the £12bn of welfare savings aren't government policy: the Liberal Democrats aren't signed up to them, so the OBR cannot take them into account when making budget projections.

Second, George Osborne has not given any clue about how which benefits recipients would feel the pain - other than to give a broad hint that it won't be pensioners (who, coincidentally, have a disproportionately high propensity to vote in general elections).

And as for the £5bn from tax avoidance and so on, well that is a number plucked from the air.

The point is that if the Chancellor and Chief Secretary to the Treasury had the faintest idea how to raise that £5bn from tax avoidance, evasion and aggressive tax planning, they would have announced it yesterday - because cracking down on tax cheats is not exactly a vote loser for either the Tories or the LibDems.

That it wasn't announced makes it (ahem) a bit dubious.

But at this point I do have to make a humiliating confession. On the News at Ten last night I made a dreadful schoolboy error.

I said that in the current parliament the Treasury had failed to make anything like £12bn of cuts to the welfare budget.

I was looking at the way the budget for assorted benefits and pensions had grown over the past few years.

But, of course, that was dumb dumb dumb. George Osborne has reduced considerably how much is shelled out on welfare compared to what was forecast in 2010, when he took office.

He says he has saved £21bn, while the independent Institute for Fiscal Studies says he has saved £17bn.

Either way, the Chancellor has cut more than the £12bn he wants to trim from planned annual welfare budgets in the second and third years of the next parliament.

But even if he did cut more than £12bn in the current parliament, it won't remotely be easy to find that sum in the next few years.

As the IFS points out, he has already made some of the simpler savings.

Thus the largest single policy initiative was to change the inflation measure used for uprating social security benefits - and presumably he can't change his mind again about which is the most relevant way of assessing increases to the cost of living.

And the furore over other big welfare reforms, such as cuts to disability living allowance and the imposition of the "under occupancy" or "bedroom" tax, show quite how hard it is reduce these costs.

So where could the axe fall?

Well the IFS says that "continuing the Conservatives' proposed freeze of most working-age benefits for five years would only reduce spending by £6.9bn".

And if George Osborne tried to stem the rise and rise of housing benefit, and made tenants pay 10% of rent, that would yield £2.5bn. Also the total abolition of child benefit, offset by compensation paid to those on lowest incomes, would give him £4.8bn.

None of these would be uncontroversial. None of them on their own would deliver £12bn.

So can the Chancellor go through a general election without spelling out in more detail precisely which welfare recipients he would make poorer?

That would not be easy - because it is one of the big questions he will now be asked relentlessly.

UPDATE: 14.26

When I described myself this morning as dumber than a dumb thing for saying on the Ten last night that the Government has failed to reduce welfare spending by £12bn in this parliament, it turns out I was less dumb than I thought.

Or at least that is what Jonathan Portes, director of the respected National Institute of Economic and Social Research, tells me.

He says that, in fact, all the cuts made by George Osborne and the Government to welfare spending have been offset by higher other payments, and net welfare spending has barely fallen at all.

Which reinforces the argument that a Tory government would find it highly challenging to cut £12bn in the next parliament.

Here is Jonathan Portes's note about all this:

Dear Robert

You said in your blog:

"I said that in the current parliament the Treasury had failed to make anything like £12bn of cuts to the welfare budget.

"I was looking at the way the budget for assorted benefits and pensions had grown over the past few years.

"But, of course, that was dumb dumb dumb. George Osborne has reduced considerably how much is shelled out on welfare compared to what was forecast in 2010, when he took office.

"He says he has saved £21bn, while the independent Institute for Fiscal Studies says he has saved £17bn."

Right first time.

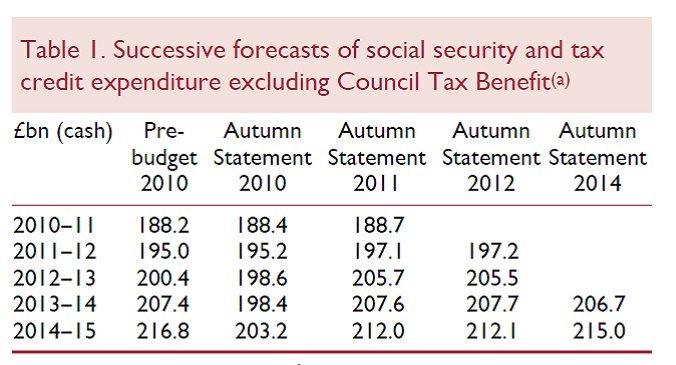

George Osborne has saved almost nothing compared to what was forecast in 2010, as this table, from Declan Gaffney's article in our latest Review here, shows, external. It is true that the IFS analysis suggests that discretionary policy changes have "saved £17bn" compared to what would otherwise have happened, but that's different: that has been almost entirely offset by other changes, policy and non-policy driven, that have pushed up spending relative to forecast. As Declan also explains, this is mostly extra Housing Benefit spend (higher rents) and Employment and Support Allowance (the disastrous implementation of the Work Capability Assessment).

Here are the numbers: