What does non-dom mean and how are the rules changing?

- Published

The Chancellor Rachel Reeves has said plans to abolish non-dom status will be amended to allow a more generous transition phase.

The move follows concerns the planned changes could prompt wealthy people to leave the UK.

What is a non-dom?

"Non-dom" describes a UK resident whose permanent home - or domicile - for tax purposes is outside the UK.

It refers to a person's tax status, and has nothing to do with their nationality, citizenship or resident status - although it can be affected by these factors.

A non-dom only pays UK tax on the money they earn in the UK. They do not have to pay tax to the UK government on money made elsewhere in the world (unless they pay that money into a UK bank account).

For wealthy individuals, this presents the opportunity for significant - and entirely legal - savings, if they nominate a lower-tax country as their domicile.

One of the most well-known non-doms is former Prime Minister Rishi Sunak's wife, Akshata Murty.

After details of her status emerged, she said she would start paying UK tax on her earnings generated outside the UK.

Akshata Murty with her husband, former Prime Minister Rishi Sunak

How are the non-dom rules changing?

Before July's general election, Labour said it would toughen existing Tory plans to abolish non-dom tax status.

In March 2024, the-then Conservative Chancellor Jeremy Hunt had announced that the non-dom tax regime would be phased out.

Under Mr Hunt's plans, people who moved to the UK from April 2025 would not have to pay tax on money they earned overseas for the first four years.

After that period, if they continued to live in the UK, they would pay the same tax as everyone else.

Existing nom-doms would be allowed a two-year transition period, during which they would be encouraged to bring their foreign wealth into the UK system.

The former chancellor said getting rid of the non-dom rules would raise £2.7bn a year by 2028-29.

Labour's October 2024 Budget confirmed that non-dom status will be abolished from April 2025. It will be replaced it with a residence-based regime, which will also bring foreign earnings into the UK inheritance tax system.

At the time, Labour said it would extend the transition period for people to bring money onshore from two years to three.

Speaking at the World Economic Forum in Davos in January, Rachel Reeves said she would "tweak" the transition period further to make it more attractive.

A recent report from global analytics firm New World Wealth and investment migration advisers Henley & Partners, external said that more than 10,000 millionaires left the UK in 2024, a 157% increase on the previous year. It said the non-dom rule changes were partly responsible.

Announcing her decision to tweak the transition period, Reeves said: "We have been listening to the concerns that have been raised by the non-dom community."

The government still expects the package of measures to raise £12.7bn over the next five years.

How do you become a non-dom?

Under the present system you can become a non-dom in two main ways:

Domicile of origin - if you were born in a different country from the UK, or if your father came from a different country

Domicile of choice - if you are over 16 and choose to leave the UK and live indefinitely in another country

Many of the UK's non-doms live in central London areas such as Westminster and Kensington

What are the current rules for non-dom status?

If you are a non-dom, external and you choose not to pay tax in the UK on your overseas earnings, you must pay:

£30,000 if you've been here for at least seven of the previous nine tax years

£60,000 for at least 12 of the previous 14 tax years

In 2017, the non-dom rules were changed to mean you can no longer claim this status if you have been a UK resident for 15 out of the previous 20 years, or if all the following conditions apply:

you were born in the UK

your domicile of origin was in the UK

you were resident in the UK for at least a year since 2017

However, if you earn less than £2,000 a year from foreign earnings, and you do not bring that money into the UK, you do not have to do anything.

How many non-doms are there and who are they?

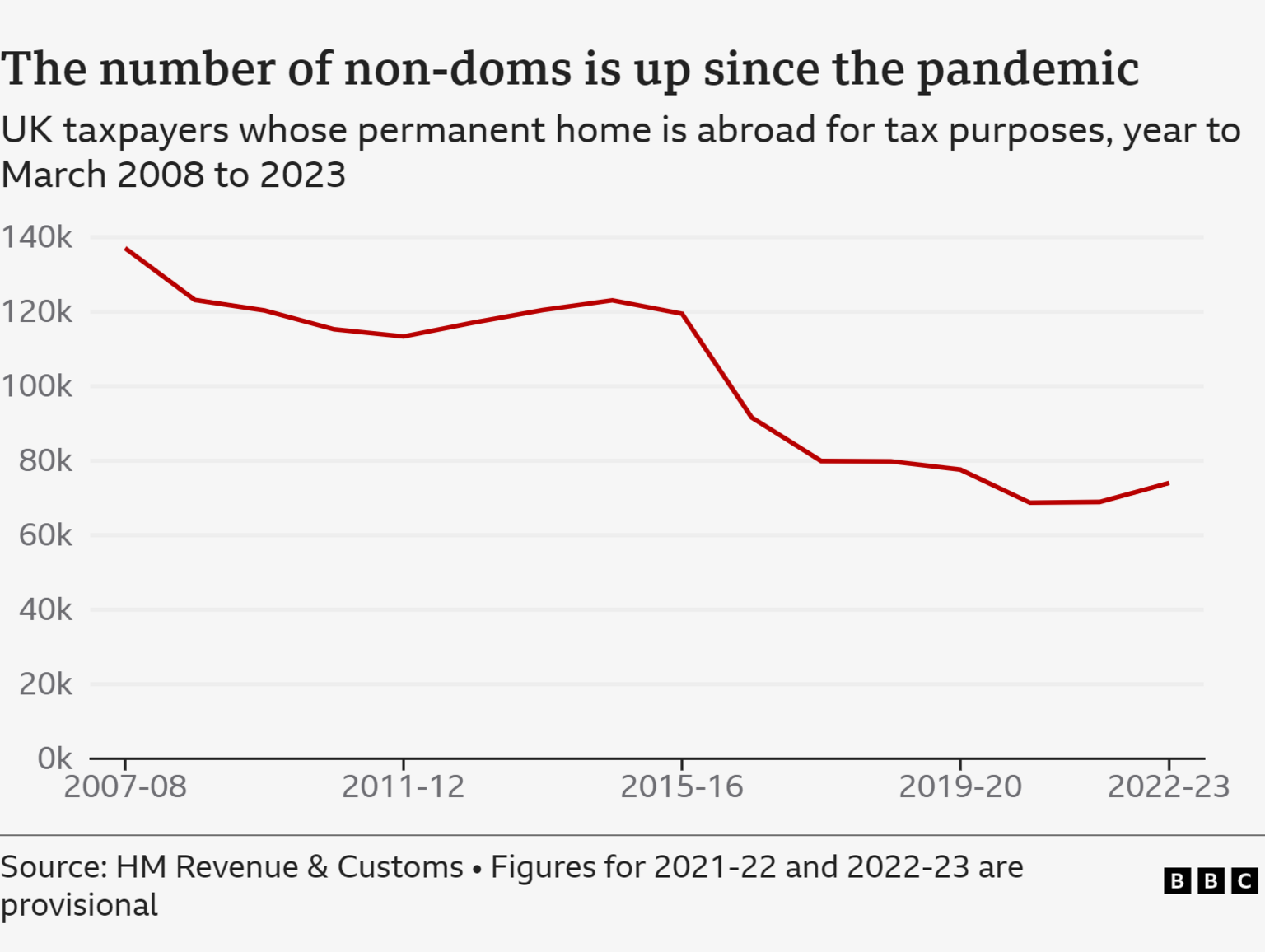

According to the latest figures from HM Revenue & Customs (HMRC), external, 74,000 people claimed non-dom status in 2022-23.

That was up from 68,900 in 2021-22, which HMRC said represented an increase in numbers of non-domiciled taxpayers after the Covid pandemic.

A study of people who were non-doms in 2018, external, or who had claimed non-dom status since 1997, found that:

more than 93% were born abroad, and another 4% had lived abroad for a substantial period

three in 10 people who earned £5m or more claimed non-dom status, compared with fewer than three in 1,000 among those earning less than £100,000

most non-doms came from Western Europe, India and the US, although there had been a rapid rise since 2001 of non-doms from China and former Soviet states

most lived in and around London - and more than one in 10 adults in Kensington, the City of London and Westminster were, or had been non-dom