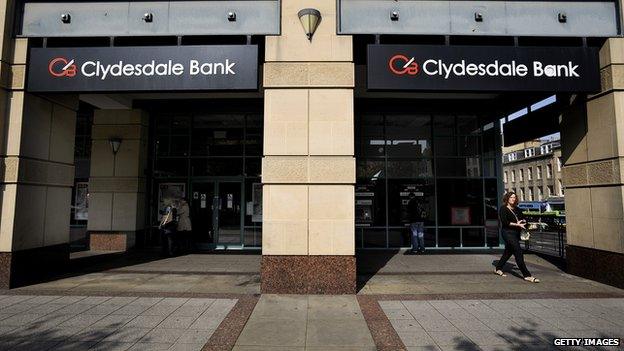

Clydesdale Bank fined £20.7m over PPI failings

- Published

The Clydesdale Bank has been fined £20.7m by the City regulator for "serious failings" in the way it handled complaints about Payment Protection Insurance (PPI).

The fine is the largest of its type imposed by the Financial Conduct Authority (FCA).

As many as 93,000 customers may be entitled to refunds or additional compensation, the FCA announced, external.

The Clydesdale apologised, and said it had now changed its procedures.

The fine relates to a policy change in May 2011, which meant complaint handlers did not take all relevant documents into account when assessing whether customers had been wrongly sold PPI.

The bank - which has 2.5 million customers in the UK - also provided false information to the Financial Ombudsman Service between May 2012 and 2013.

In a small number of cases, bank employees "altered certain system print outs" to make it look as though Clydesdale held no relevant documents.

"The fact that Clydesdale misled the Financial Ombudsman by providing false information about the information it held is particularly serious," said Georgina Philippou, acting director of enforcement and market oversight at the FCA.

Staff also deleted information about PPI sales from customer records, the authority said.

It added that the practices had not been authorised by managers.

'Immediate steps'

The Clydesdale, which is headquartered in Glasgow, said 180,000 files were now being reviewed to see if customers may be due compensation.

After apologising for the mistake, it said it had already made changes.

"As soon as this issue was discovered, we took immediate steps to stop it; we made the regulator aware and rapidly introduced strict new monitoring procedures to prevent any recurrence," said acting chief executive Debbie Crosbie.

The Clydesdale, together with its sister brand Yorkshire Bank, has set aside £806m to deal with PPI mis-selling.

In total, £18.5bn has now been paid out to customers of all banks and credit card firms who were wrongly sold PPI since January 2011.

The insurance was supposed to cover mortgage or loan repayments in the event of redundancy, but for many people the insurance was not necessary.

The bank was previously fined, external £8.9m in September 2013 after miscalculating the mortgage repayments of more than 42,000 customers.

- Published6 January 2015

- Published29 August 2014