RBS posts £446m first-quarter loss

- Published

Legal and restructuring costs have pushed Royal Bank of Scotland into the red for the first quarter of 2015.

The 80% taxpayer-owned bank reported a loss of £446m for the three months to 31 March.

The loss followed an £856m provision for "litigation and conduct charges", as well as £453m for restructuring costs.

The result compared with a profit of £1.2bn profit last year, when there were fewer one-off costs.

Excluding these charges, adjusted operating profit rose 16% to £1.63bn as RBS benefited from "generally benign credit conditions".

The bank said it was making good progress towards its targets for 2015 and creating a "stronger, simpler" business.

In the wake of allegations about foreign exchange manipulation, RBS set aside £334m to cover investigations and penalties.

It was one of six banks fined a total of about £2.8bn for failing to stop traders trying to manipulate currency markets last year.

RBS has already paid £399m in fines to US and UK regulators over the forex scandal.

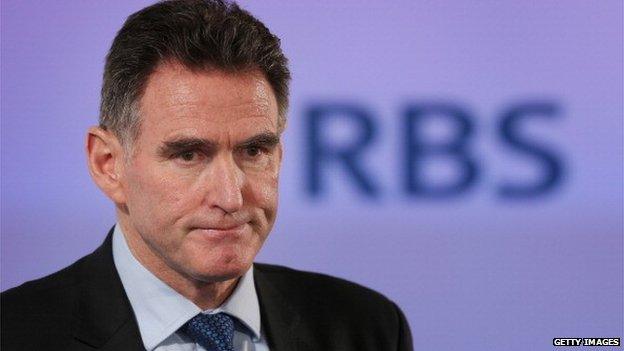

Chief executive Ross McEwan said the bank's performance was not satisfactory: "I won't be satisfied until we're making money and doing great things for customers."

There were "still many conduct and litigation issues on the horizon" for RBS, he added.

RBS chief executive Ross McEwan

Barclays, which has yet to reach a deal with regulators over the forex allegations, on Wednesday set aside another £800m to cover the issue.

RBS has also made a provision of £257m for customer complaints about certain bank accounts, £176m for US legal action over the sale of mortgage-backed securities and a further £100m for payment protection insurance.

The restructuring costs include provisions for reducing the size of its investment banking operations as the bank refocuses on the UK, as well as writing down the value of premises in the US.

Revenue for the first quarter was £4.33bn - 14% lower than the same period in 2014, but 12% higher than the final three months of last year.

In February, RBS reported a loss of £3.5bn for 2014 - less than half the £9bn loss for the previous year.

'Litany of woes'

Shares in RBS fell 3.1% to 338.5p, bringing the slide in the stock to more than 13% this year.

Richard Hunter, head of equities at Hargreaves Lansdown, said: "For RBS, the litany of woes remains a drag on profits and prospects. All may not be lost, but the group seems to be a glass half-empty. Investors have long since lost patience, with the perception of better value elsewhere."

- Published26 February 2015

- Published27 March 2015

- Published23 March 2015