Will Britain's HSBC move back to its original home?

- Published

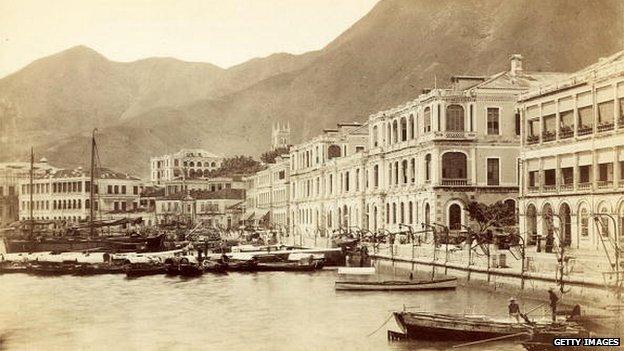

HSBC could end up back where it started in 1865

HSBC, Europe's largest bank, may be on the lookout for a new home.

When it announced its plan to review where to have its headquarters, external, it made passing references to "regulatory and structural reforms" and the UK's plans to "ring fence" retail banks.

Some shareholders think a higher dividend would be available if the bank moved from London to a city with lower taxes and looser capital controls, according to people close to the lender.

It pays the most out of the UK's lenders on the banking levy, handing over $1.1bn (£716m) to Britain's Treasury last year.

But if it does decide to move, where could it go?

The challenges for the bank include finding a city with a skilled regulator which will welcome them, a stable business environment and preferably a location with clients and bankers to hire.

'No brainer'

Further down the wish list for HSBC - but not for any employees it may need to move - will be a city with good schools and cultural amusements.

"It's a no brainer, it has to be Hong Kong," says Chirantan Barua, senior analyst for UK banks at Bernstein Research.

"The Hong Kong regulator leads the world in macroprudential (economy-wide) regulation...what the Bank of England has rolled out in UK mortgages is a leaf out of the HK rule book."

Hong Kong has changed a lot since HSBC was first established in the territory in 1865

One worry is the size of Hong Kong's economy compared with the size of HSBC and how it could support the bank if there was another financial crisis.

But both the local regulator, the Hong Kong Monetary Authority (HKMA), and Mr Barua think this is less of a concern than it was before.

"After the global financial crisis, there is generally consensus internationally that public funds should not be used to rescue financial institutions in distress," HKMA said in an email to the BBC.

Regulators are working towards a situation where a bank can be dismantled without threat to the global economy, should it go bust, it said. The bank has never burned through more than about one-sixth of its capital safety buffer in any crisis, estimates Mr Barua.

The monetary authority says it "takes a positive attitude should HSBC consider relocating its headquarters back to Hong Kong."

The bank itself declined to comment further.

Hong Kong

-

Large market for HSBC

-

Friendly and respected regulator

-

The bank's former home

-

But: Uncertain influence from China

-

Close competitor to HK in Shanghai

Abu Dhabi or Dubai

-

Welcoming regulatory environment

-

Low tax

-

But:

-

Few other large banks

-

Other authorities may view the region with caution

State interference

On the other hand, says Peter Hahn, senior lecturer at Cass Business School, the lender could be better served by looking elsewhere. "They have a sizeable footprint in the US, they have to be there for big corporations."

In 2012 the bank paid $1.9bn to US regulators in a settlement over breaching money laundering regulations. But any bank that wants access to dollars - and HSBC does - needs to keep US regulators sweet.

A move to Hong Kong could make the bank more vulnerable to the state interference they seek to avoid, he says.

Part of the question is whether HSBC is leaving the UK for Hong Kong or returning there.

Paris or Frankfurt

-

Inside the EU should the UK decide to leave

-

Large pool of corporations with which to do business

-

But:

-

Smaller areas of business than Hong Kong or London

-

Similar financial rules, potentially tougher on pay

The Hong Kong in which HSBC was founded in 1865 was under British rule, as was the Hong Kong HSBC left as a headquarters in 1993 to move to London.

The territory is now is a special administrative region of China, which agreed to give the territory a high degree of autonomy and to preserve its economic and social systems for 50 years from the handover in 1997.

"The trade-off is when China tells its banks to lend more, will HSBC have to lend more? The answer is probably yes," says Mr Hahn.

European options

For him, Switzerland, a traditional home for banking, could be out because of the country's efforts to make their banks safer and reduce the risk to the government of them failing. That, he says, probably means repelling large newcomers.

"If [HSBC chiefs] Douglas Flint and Stuart Gulliver got on a jet and said they were moving to Switzerland, Swiss national bank governor Thomas Jordan would be stood on the runway with a shotgun telling them to get back on the plane," he jokes.

Switzerland

-

A traditional home for banking

-

Large pool of bankers to hire

-

But:

-

Swiss regulators demand banks hold more capital as a safety net, which is more expensive

-

Private banking is a smaller (and shrinking) area of business for HSBC

Ismail Erturk, senior lecturer at Manchester Business School, says fewer connections to the political establishment in the US could rule it out. Whereas in Hong Kong, the bank could be central to Chinese efforts to increase the world's use of its currency, the renminbi.

A base in France could be thwarted if the lender needed help and the government had to choose between saving historically French lenders and a newcomer, he adds.

So, back to London?

Other than taxes and levies, the government's ring fencing plan may be the bone of contention for HSBC that everyone's forgetting, says Dalvinder Singh, professor of financial regulation at the University of Warwick.

"HSBC has not liked what the government has done on various levels. HSBC is getting more conservative and retracting from riskier business and perhaps feels it doesn't need to be told how the business is run, because it has learned," he says.

New York

-

Closer to some of the world's largest businesses

-

Banks are a small part of US economy compared with other cities, mitigating bailout risk

-

Large pool of bankers to hire

-

But: US authorities fined the bank $1.9bn

-

HSBC's businesses less profitable in the US than other markets

As you were?

This may mean the review is "sabre rattling" rather than the prelude to a move, he says.

If rates were higher and business were better, some of the arguments may have been moot, says Mr Barua.

"If interest rates in the US and UK were at 2%, George Osborne or Ed Miliband could have increased the bank levy by another whatever, and no-one would care.

"Low rates mean you don't have enough earnings," he says.

"How do you move the value of the stock if you can't earn your way out?"

- Published24 April 2015

- Published10 February 2015

- Published24 April 2015